Nigeria’s trade with the rest of Africa is surging in naira terms. Still, it remains well below pre-pandemic levels when measured in dollars, according to Finance in Africa’s analysis of the National Bureau of Statistics (NBS) latest trade data.

In the first six months of 2025, Nigeria’s trade with African countries totalled $3.13 billion (₦4.82 trillion).

While this marks an improvement from the pandemic slump — $2.86 billion (₦963.62 billion) in H1 2020 and $2.47 billion (₦963.64 billion) in H1 2021 — it is still 30.6% below the $4.51 billion (₦1.38 trillion) recorded in H1 2019 before COVID-19 disrupted flows.

In naira terms, however, trade tells a very different story, soaring from ₦1.38 trillion in H1 2019 to ₦4.82 trillion in H1 2025 — a 248% increase. The contrast highlights how the naira’s steep depreciation has distorted the appearance of trade growth.

Exports and imports: Diverging narratives

Exports to Africa reached $3.13 billion (₦4.82 trillion) in H1 2025, down in dollar terms by 36.5% from $4.93 billion (₦1.51 trillion) in H1 2019, even as naira values suggested a 218% surge.

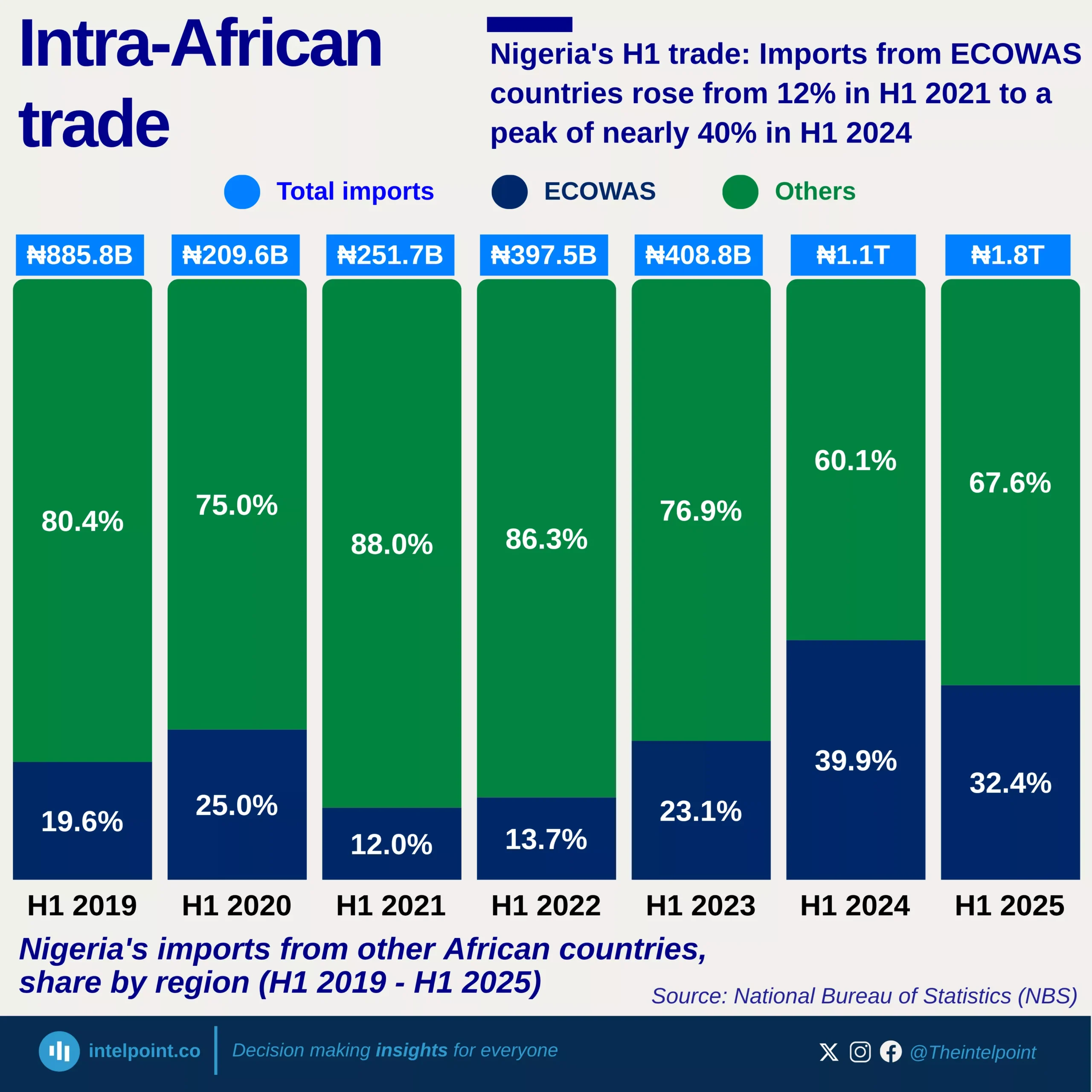

Imports fell even more, dropping by 59% to $1.19 billion (₦1.82 trillion) in H1, compared to $2.89 billion (₦885.8 billion) in H1 2019. In naira terms, however, imports more than doubled.

ECOWAS gains, wider Africa retreat

Within the continent, Nigeria’s trade with the Economic Community of West African States (ECOWAS) has proven more resilient. Trade with the bloc rose to $1.95 billion (₦2.99 trillion) in H1 2025, up 33% from $1.46 billion (₦447.6 billion) in H1 2019.

Exports to ECOWAS grew 15% to $1.95 billion ($259 million gain), while imports climbed 31% to $384.3 million. In naira terms, both figures skyrocketed due to currency depreciation.

Outside ECOWAS, however, trade has collapsed. Dollar trade with non-ECOWAS African countries dropped 61% to $1.19 billion in H1 2025, compared with $3.05 billion six years ago. Exports plunged 63%, while imports fell 65%.

This underscores a structural shift: Nigeria is deepening ties within ECOWAS but losing ground across the wider continent.

The long shadow of the pandemic

The pandemic years dealt a severe blow to regional trade, with dollar values bottoming at $2.18 billion in H1 2022. Since then, a fragile recovery has lifted trade to $3.13 billion in H1 2025, but levels remain well below the pre-2019 benchmark.

According to a recent report by Cowry Research, the country’s foreign trade performance in the first half reflects both the benefits of resilient export receipts and the moderating effect of policy-induced import compression.

It added that imports remain subdued due to high foreign exchange costs, but “recent signs of FX market stability with reduced volatility and more predictable rate pricing suggest import activity could stage a gradual rebound in the quarters ahead.”

Naira has lost 80% of its value since 2019

The trade paradox is rooted in the naira’s collapse. Between H1 2019 and H1 2025, the currency lost roughly 80% of its value, weakening from ₦306.73/$ to ₦1,538.50/$. This collapse has inflated naira trade values while masking stagnation in dollar terms.

Although the naira strengthened to ₦1,480.3/$ on September 26, 2025 — its highest level in eight months — analysts caution it remains significantly overvalued. Renaissance Capital estimates the currency is 26% above its 25-year real effective exchange rate average, making it the “most expensive” in Africa on that measure.

The sustained depreciation explains Nigeria’s trade paradox: in naira terms, trade looks to be booming; in dollar terms, it remains stagnant or contracting. Unless the exchange rate is stabilised, Nigeria’s intra-African trade will continue to look inflated at home but underwhelming abroad.