In 2024, the total value of trade between the United States and Africa stood at $71.6 billion, with the U.S recording a deficit of $7.4 billion. The continent’s biggest trade partners with the United States are South Africa, Nigeria, Ghana, Kenya, Egypt and Angola.

However, all these have been pushed to the precipice as President Donald Trump’s reciprocal tariff was slammed on every country in the world, including those in Africa.

Many have argued that the tariffs on African countries goes contrary to the spirit of the Africa Growth and Opportunity Act (AGOA)- a piece of legislation that grants duty-free access for exporters from Sub-Saharan Africa to the U.S markets with the aim of accelerating economic development in the region.

In the past years, countries like South Africa, Lesotho, Kenya, Côte d’Ivoire, Madagascar etc, have increased their non-oil exports, taking advantage of the AGOA initiative. These countries supply everything from vehicle spare parts from South Africa to apparel, cocoa, copper, jewelry, precious stones, etc.

Exports of non-oil products have seen exponential growth since 2001 when AGOA started. Between 2001 and 2022, exports of non-oil products increased almost threefold (241%) compared to crude oil, which decreased by 50% in the same period.

In recent times, the following products have dominated non-oil exports from Africa to the United States. They are apparel and textile, cocoa, copper, jewelry, vehicles and vehicle spare parts, ferroalloys, and other agricultural products.

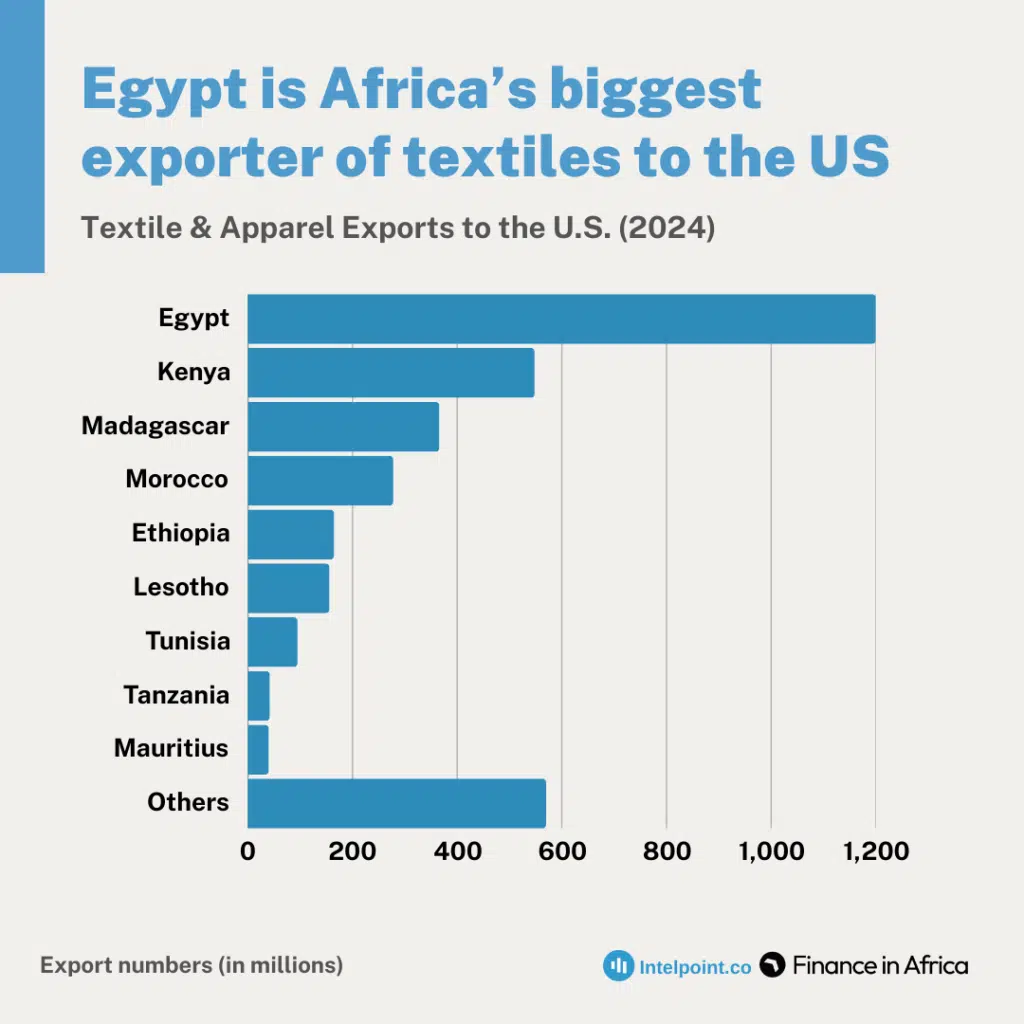

Apparel and textile products

The total textile and apparel exports from African countries to the United States stood at $3.46 billion in 2024. Egypt led the way, shipping up to $1.2 billion worth of clothing and textile products in the year under review.

Kenya trailed Egypt in terms of apparel exports to the U.S, with $548 million worth of textile and clothing products. Other African countries were Madagascar ($366 million), Morocco ($278 million), Ethiopia ($165 million), Lesotho ($156 million), Tunisia ($95 million), Tanzania ($42 million), Mauritius ($40 million) and others.

The major casualty of President Trump’s tariffs in Africa is Lesotho whose exports to the United States constitute about 10% of her GDP, and apparel and textile exports represent about 66% of her exports in 2024.

Textile and apparel imports to the United States are dominated by China, India, Bangladesh, Vietnam and Mexico. However, these countries also have their fair share of President Trump’s reciprocal tariff and even higher in the case of China.

For example, China and Vietnam were slapped with 54% and 46% tariffs, respectively, while Mexico has already been targeted by earlier President Trump’s Executive Orders (EO). India and Bangladesh’s rates were 27%.

The high tariff on African countries’ exporting apparel and textile products to the U.S will stand a chance to compete as they have one of the lowest tariff rates, barring Lesotho and Mauritius.

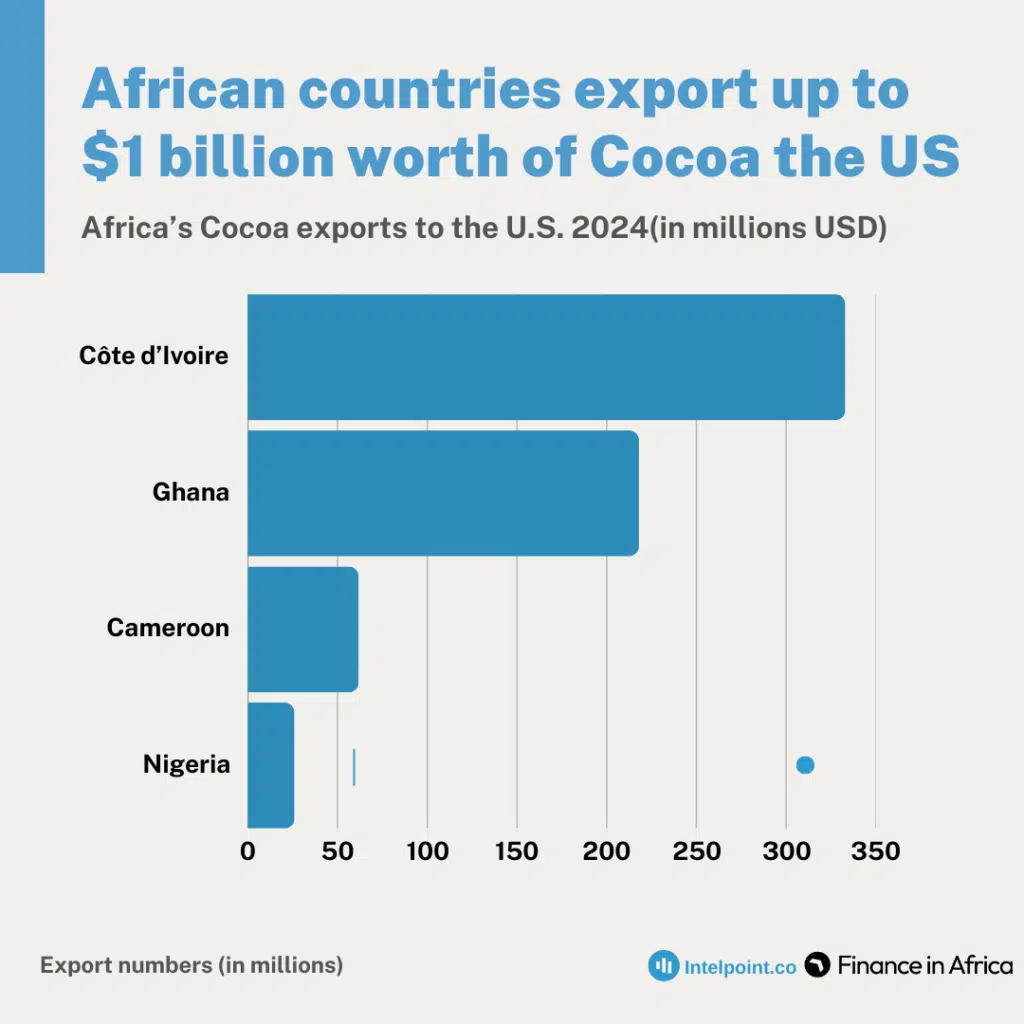

Cocoa

The major cocoa exporters in Africa are Cote d’Ivoire, Ghana, Nigeria and Cameroon. Cocoa beans and paste exports from Africa to the United States were estimated to be $1 billion in 2024.

According to the United Nations (UN) data, Nigeria exported $26 million worth of cocoa in 2024. On the other hand, Cameroon exported $61.7 million worth of the product in the same year, while Ghana exported $218 million.

Among the four largest exporters of cocoa products to the U.S in 2024, Cote d’Ivoire, which exports up to $333m, has the largest tariff at 21% followed by Nigeria with 14% and Cameroon with 11%, with the lowest being Ghana.

Africa’s cocoa exporters have an advantage since they are the major suppliers of cocoa to the world, meaning there will always be demand for their products despite President Trump’s reciprocal tariff.

However, the potential increase in the prices of its raw materials might compound the woes of chocolate producers, who have seen cocoa price surges to record levels in 2024.

Gold and diamond

This industry has been dominated by major gold producers and exporters in Africa- South Africa, Ghana, Nigeria and Egypt. For example, in 2023, over 50% of South Africa’s $371 millionin jewelry exports landed in the United States. It is important to note that gold is exempted from this ‘reciprocal tariff’ by the U.S govt.

While Ghana is a major exporter of gold in Africa, the United States is not the major destination of its gold. Countries like Switzerland, China, the UAE, South Africa and India are taking the lead.

Nigeria’s gold mining industry is yet to find its feet, it was able to sell a fair amount of gold but not to the United States as in the case of South Africa.

Vehicles and vehicle spare parts

This industry spans South Africa and Morocco – the two most advanced vehicle manufacturing countries on the continent. Morocco, which in recent times has grown to become the continent’s bigger vehicle manufacturers competing with Europe and China, saw its vehicle exports to the United States reach $136 million in 2024.

On the other hand, South Africa exported up to $2 billion worth of vehicles and vehicle spare parts products to the United States in 2024. The recent tariffs place this trade in jeopardy for the South African government.

The automobile industry in the era of tariffs is an interesting one since the biggest vehicle manufacturers in Asia and Europe will see similar tariffs with South Africa or greater.

Feralloys

South Africa is the only major player in this industry in Africa. In 2024, the country exported $312 million worth of ferroalloys to the United States. However, it is an industry dominated by countries such as Brazil, China, Indonesia etc.

In reaction to the recent tariffs, South Africa could look for new markets for its products in countries within Africa or other parts of the world. This is because the United States, being a major producer, will first seek to meet local demand before exports.

Other agricultural products

The major agricultural products influencing Africa’s agro-exports are nuts, nesoil, tobacco, unmanufactured, prepared or preserved fish caviar and caviar subtitutes from fish eggs, soybean oilcake, and others.

Africa’s agro-exports are usually headlined by cocoa, hence its separate mention above. In 2024, exports of nuts oil, mostly derived from almond, cashew nut, chestnut, hazel nut, under the AGOA initiative reached $9.85 million. Meanwhile, tobacco stood at just over $6 million.

Prepared and preserved fish caviar exports to the United States in the YTD ending January 2024 was $11.04 million while soybean oilcake export in the same period stood at $10.22 million.

African countries are also big players in the coffee and tea industry. In 2022, total value of coffee exports from Africa to the world reached $3.6 billion with Ethiopia and Uganda leading the way.

Fruit and flower exports from Africa to the United States are dominated by South Africa and Kenya. Citrus, wine, grapes and fruit juices are South Africa’s major fruit exports to the world, not just the United States.

Agro-exports in the light of President Trump’s tariff presents a complex scenario majorly due to how diverse some of the supply chains are- that means different countries can replace the current suppliers if it manages to get a good deal.

Need for Africa to negotiate as a group

The current global trade order now calls for renegotiation after Pres. Trump’s reciprocal tariffs on every country of the world. This presents an opportunity for the current U.S administration to renegotiate trade deals with different countries and trade blocs. Already, there are reports that China, Japan, Vietnam and other Asian countries are planning a joint response.

The European Union (E.U.) is also expected to negotiate as a single bloc. This is the strategy African countries should deploy as it seeks to confront the present reality with regards to trade and more importantly since it has organised itself into a single trading bloc- ACFTA.

Negotiating as a bloc ensures the vulnerabilities, fears and interests of different region is addressed ensuring that no country on the continent feels left behind.