Three Nigerian lenders—Stanbic IBTC Holdings Plc, Wema Bank Plc, and Access Holdings Plc—dedicated the largest proportion of their earnings to staff compensation in 2024, highlighting the growing cost of doing business and intensifying competition for skilled talent in Africa’s most populous country.

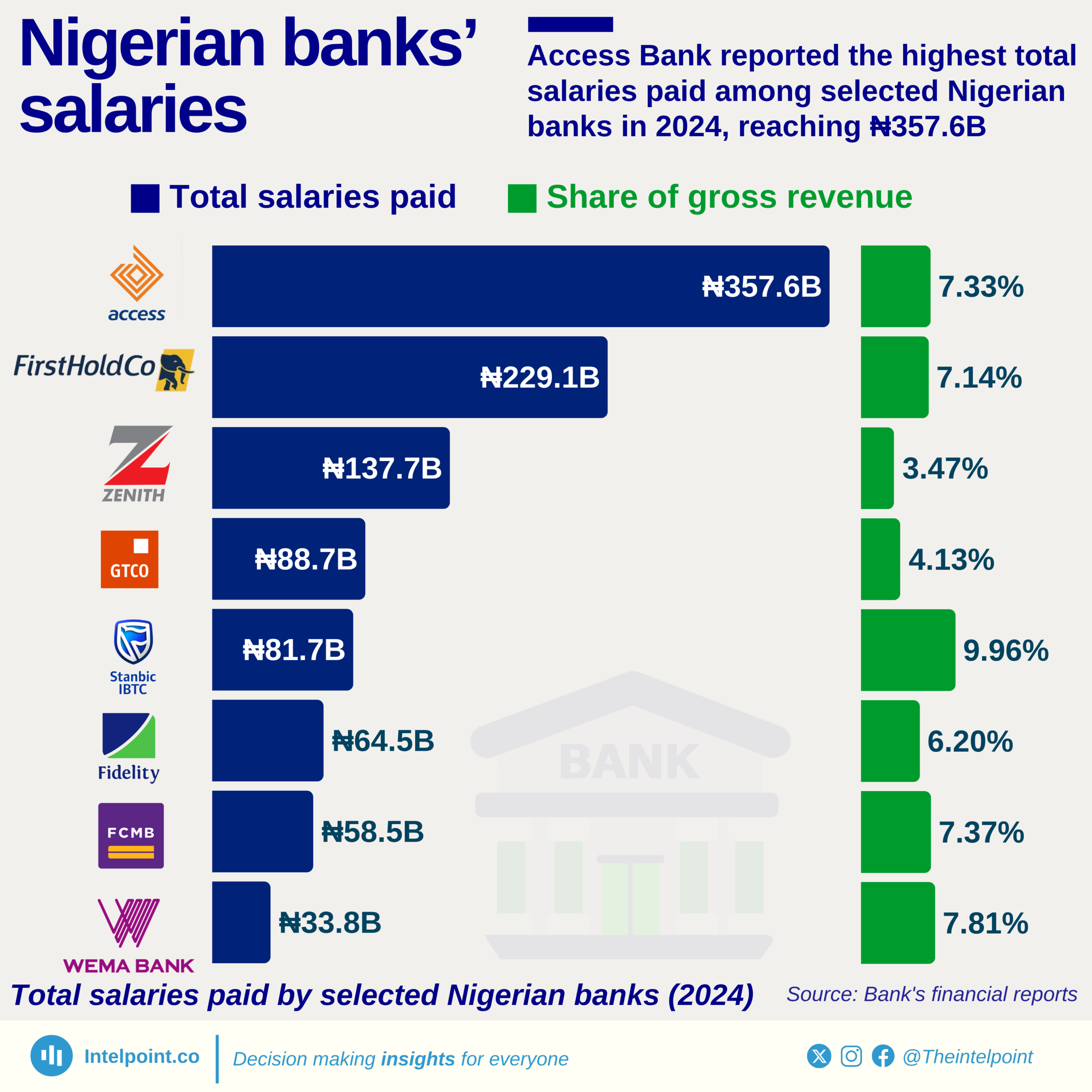

According to a Finance in Africa analysis of eight major commercial banks, Stanbic IBTC led the pack, allocating 9.96% of its gross earnings to wages and salaries. Wema Bank followed with 7.81%, while Access Holdings came in third at 7.69%.

Stanbic has consistently topped this metric for three consecutive years—13.3% in 2023 and 17.6% in 2022—reflecting its executive-heavy pay structure and inflation-linked adjustments.

These rising staff cost ratios point to a shift in operational priorities across Nigeria’s banking sector, driven by high inflation, currency devaluations, and an increasing war for digital and technical talent.

“Staff costs also grew year— on-year by 32%, driven by inflation adjustments to salaries and enhanced benefits,” Stanbic noted in its 2024 annual report.

Wema Bank, which approved salary increases in 2023, said the move was part of a broader strategy to support staff amid economic headwinds. “It positioned us as not just a partner to our customers, but to our employees as well,” said Mabel Adeteye, head of brand and marketing communications.

“Smaller banks often need to match the pay structures of bigger institutions to retain talent, despite being less productive,” said Tony Brown, an Abuja-based banking analyst. “If they don’t raise pay, they lose their best people.”

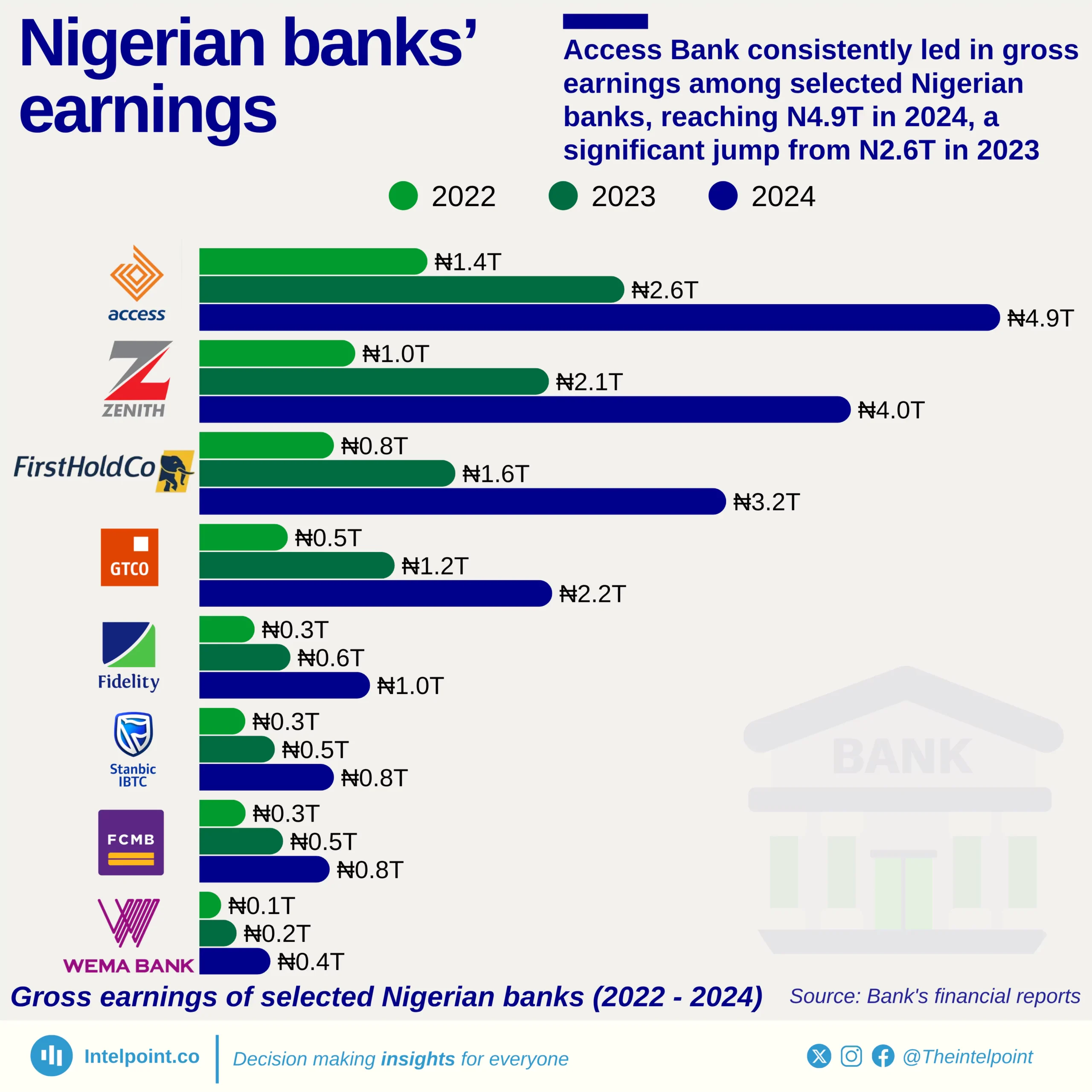

Further analysis shows that gross earnings for the sector rose sharply in naira terms to ₦17.3 trillion in 2024, up from ₦9.22 trillion in 2023 and ₦4.73 trillion in 2022. However, when converted to US dollars, the figures reflect a decline — dropping to $11.7 billion in 2024 from $14.3 billion in 2023, and $11.1 billion in 2022 — due to currency depreciation.

Similarly, total staff salaries crossed the ₦1 trillion mark for the first time, reaching ₦1.05 trillion in 2024, compared to ₦599 billion in 2023 and ₦429 billion in 2022. Yet in dollar terms, salaries fell to $709.9 million in 2024, down from $928.4 million in 2023 and $1.01 billion in 2022.

The spike in naira earnings was fueled by the federal government reforms, including two rounds of naira devaluation in July 2023 and January 2024, and rising interest income following the Central Bank of Nigeria’s monetary tightening. The Monetary Policy Rate rose by 875 basis points to 27.50% between July 2023 and July 2025.

Inflation and currency woes push pay higher

In 2024, Nigeria’s headline inflation hovered around 33%, driven by petrol subsidy removal, currency devaluations, and surging import costs. In response, many banks implemented salary hikes to protect staff purchasing power.

“A lot of banks increased salaries in June 2023—some nearly doubled them,” said Ayodeji Ebo, chief business officer at Optimus by Afrinvest. “The focus was on mitigating inflation and high transport costs, particularly for junior staff.”

In absolute terms, Access Holdings recorded the highest staff bill at ₦357.6 billion ($241.8 million)—more than double the ₦160.3 billion ($108.4 million) spent in 2023. Stanbic’s salaries hit ₦81.7 billion ($55.4 million), while Wema Bank’s costs surged 77% year-on-year to ₦33.8 billion ($22.9 million).

However, when measured as a percentage of gross earnings, Stanbic still led, revealing its higher pay structure relative to revenue size.

Big banks keep ratios leaner

In contrast, larger banks reported leaner salary-to-earnings ratios. Zenith Bank spent just 3.47% of its gross earnings on salaries, despite a 48.7% jump in staff expenses. GTCO and Fidelity Bank reported 4.13% and 6.2%, respectively.

“It’s an employee-driven market now,” said Stephen, a mid-level employee at a major bank in Lagos. “With limited skilled talent, banks are offering competitive perks to retain key staff. Ironically, smaller banks sometimes pay more just to match what bigger banks offer.

Executive-heavy pay structures

Stanbic, Access, and Fidelity continue to operate executive-heavy models. According to a report, over 70% of employees at Stanbic (76.5%), Access (70.5%), and Fidelity (65.3%) earned above ₦6 million ($4,057) annually in 2024.

In contrast, Guaranty Trust Holding Company and United Bank for Africa reported more balanced pay distributions, while Wema remained junior-heavy, aligning with its mass-market retail banking focus.

2025 outlook: Slower profits, continued pay pressure

Profit growth is cooling in 2025 as one-off gains from devaluation and rate hikes taper off. According to data from the Nigerian Exchange (NGX), the combined after-tax profit of nine major banks grew by 0.74% to ₦1.35 trillion ($847.3 million) in Q1 2025—down from 274.3% growth in Q1 2024.

Despite this, banks are still investing in staff welfare. Fidelity promoted 376 employees (12% of staff) and announced a 20% pay increase—its second in eight months, following a similar raise in November 2024.

“More banks—including mine—are planning pay raises this year to remain competitive,” said Stephen.

Zenith, Wema, and Stanbic have all implemented salary adjustments, citing inflation and retention goals.

Currency conversion: $1 = ₦1,478.9 for 2024; ₦645.2 for 2023; ₦425.9 for 2022.