In an earlier report, we examined African banks with the highest profits, revealing that Nigerian banks were trailing their counterparts in Egypt and South Africa, despite a year of record-breaking profits for Nigerian lenders.

This piece explores which country’s banks performed best in terms of Return on Equity (RoE), Return on Assets (RoA), and Return on Capital (RoC). However, the curious mind might first need to understand the meaning of these terms.

Return on Equity (RoE)

This is a measure of a company’s performance, calculated by dividing net income by total equity. It reflects how efficiently a company generates profit from its shareholders’ funds and is usually expressed as a percentage.

A high RoE typically signals strong managerial efficiency, effective cost control, and a profitable lending or investment strategy. However, it can also reflect higher financial leverage or a smaller equity base. That’s why it’s important to assess RoE alongside other metrics like Return on Assets (RoA), cost-to-income ratio, and net interest margins.

While Egyptian and South African banks dominated the earlier ranking in terms of profit, their performances were more mixed when analysed through the lens of RoE. Nigerian banks actually posted better returns on equity compared to other African countries in the analysis, with the exception of Egypt.

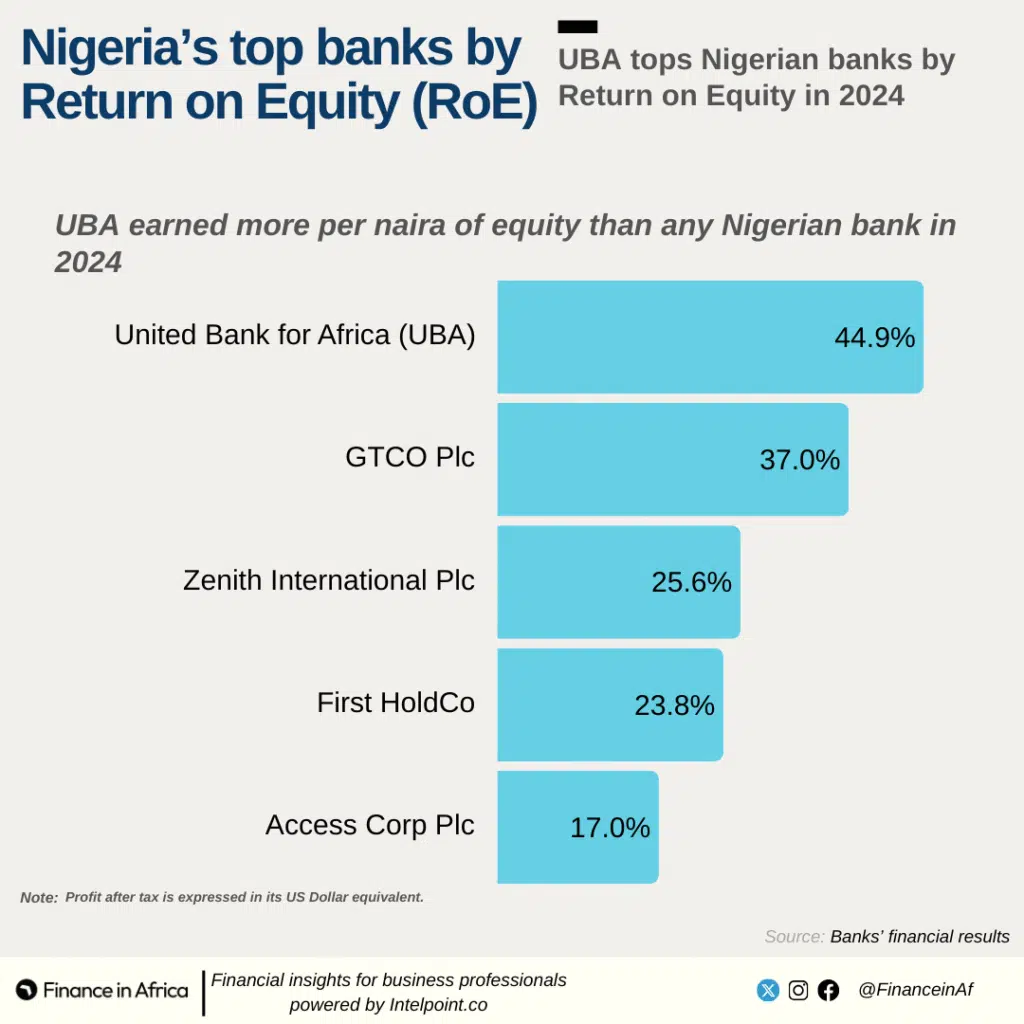

Nigeria

The top five banks in the country, commonly referred to as the FUGAZ banks, recorded an average RoE of 29.6%.

- United Bank for Africa (UBA) topped the list of Nigerian banks with the highest RoE at 44.9% in 2024, followed by GTCO Plc with 37%.

- Despite being Nigeria’s largest bank by asset base, Access Corp Plc recorded the lowest RoE among the group, at 17% in 2024, based on figures from its audited full-year report.

- First HoldCo had an RoE of 23.8%, while Zenith International Plc recorded 25.6%.

This data suggests that while the depreciation of the Naira lowered the USD value of Nigerian banks’ profits, their operational efficiency meant that shareholders in the sector continued to enjoy solid returns.

Egypt

The two Egyptian banks featured in our previous report also posted significantly high RoE figures. On average, they recorded the highest RoE in Africa among all the banks featured, with a collective average of 42.6%.

- Banque Misr recorded an RoE of 35.7%,

- Commercial International Bank (CIB) achieved a staggering 49.5% — the highest in Africa in 2024.

In this regard, Egyptian banks not only maintained their high profitability in 2024 but also consolidated their position with even more impressive returns on equity.

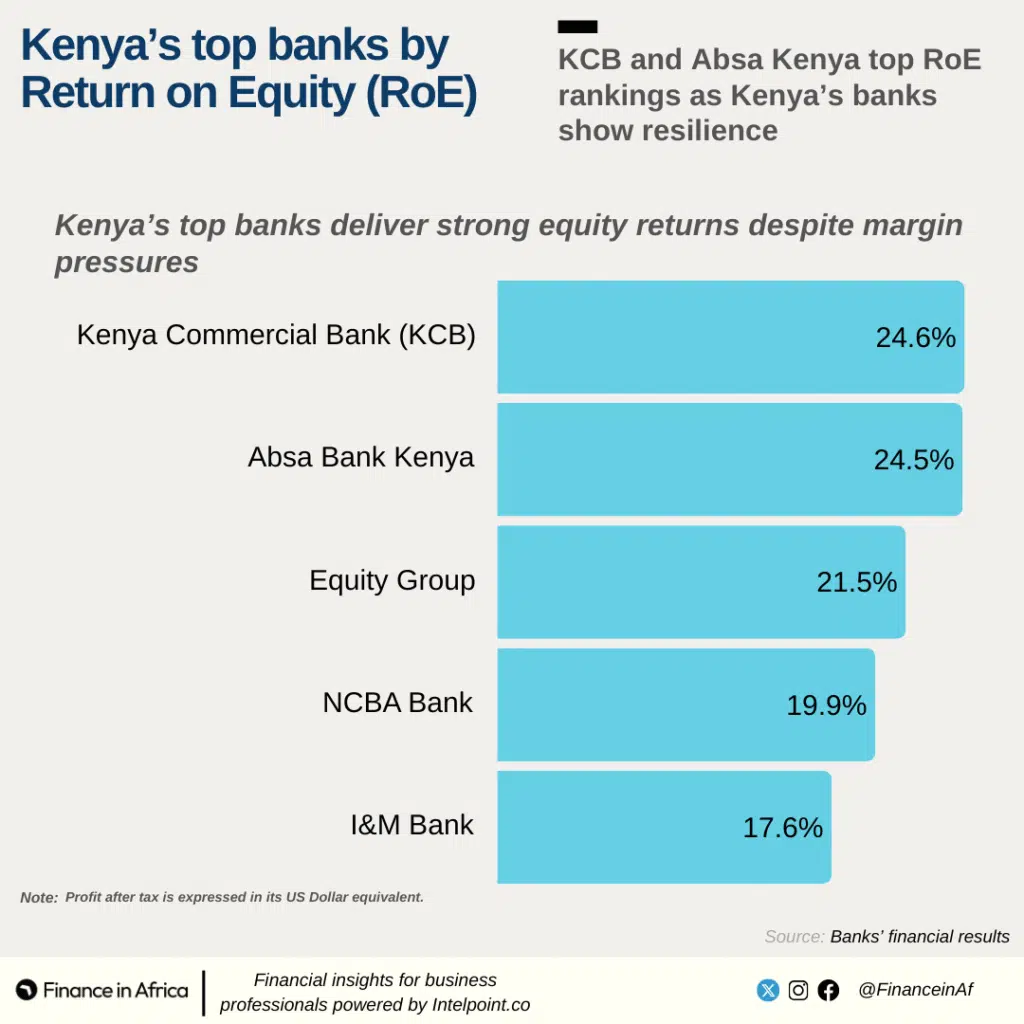

Kenya

Major banks in this East African country recorded an average Return on Equity (RoE) of 21.6%, outperforming only South Africa among the countries analysed. Kenya Commercial Bank (KCB) recorded the highest RoE at 24.6%, closely followed by Absa Bank Kenya at 24.5%.

The breakdown is as follows:

- Kenya Commercial Bank – 24.6%

- Absa Bank Kenya – 24.5%

- Equity Group – 21.5%

- NCBA Bank – 19.9%

- I&M Bank – 17.6%

This shows that while Kenyan banks maintain a relatively stable RoE, they still lag behind their Nigerian and Egyptian counterparts in terms of equity returns.

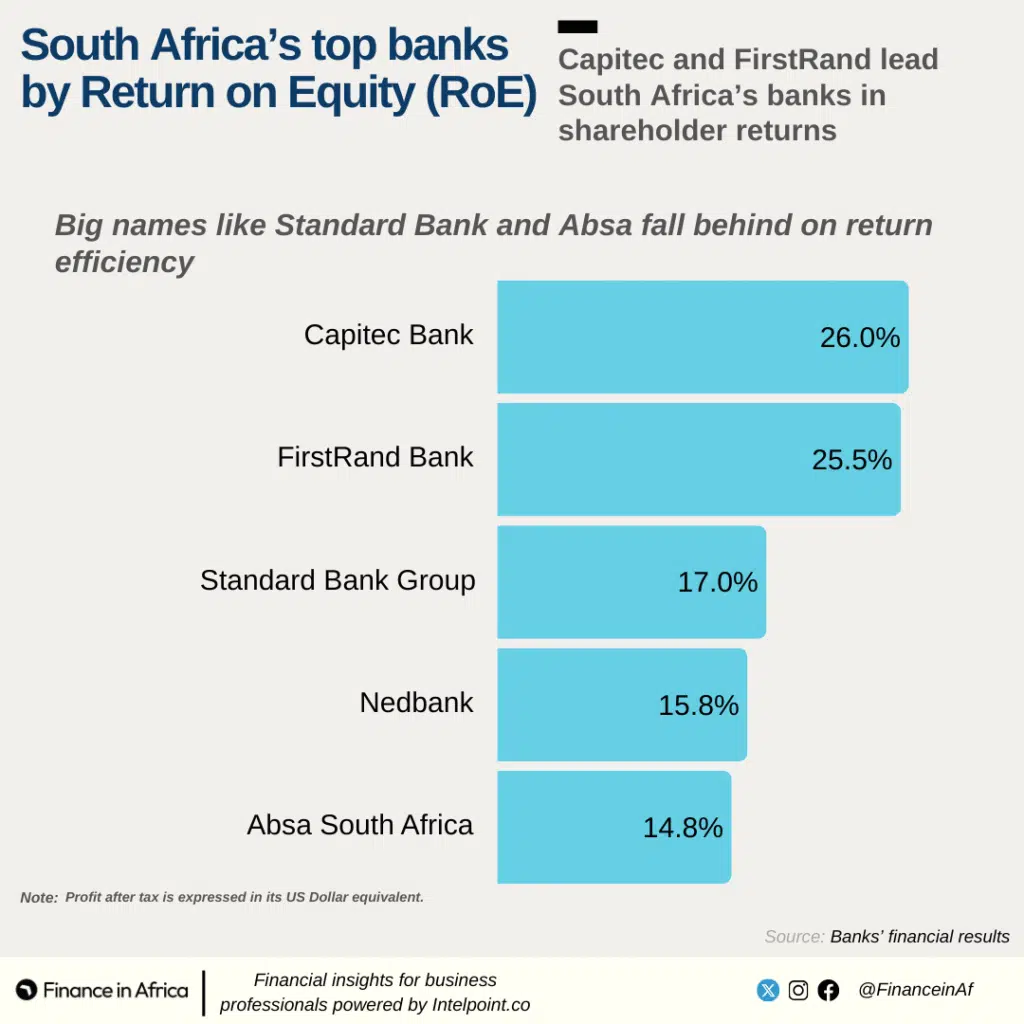

South Africa

Despite South African banks posting the highest profits on the continent in 2024, their average RoE was the lowest at just 19.1%. This underperformance reflects either a significantly larger capital base or lower profitability relative to equity.

Capitec Bank stood out with the highest RoE in the country at 26%, while Nedbank recorded the lowest at 15.8%.

Here’s the RoE by bank:

- Capitec Bank – 26%

- FirstRand Bank – 25.5%

- Standard Bank Group – 17%

- Nedbank – 15.8%

- Absa South Africa – 14.8%

This data suggests that while South African banks are profit giants, they appear to be more capital-heavy and possibly more conservative in their equity utilisation, which drags down their RoE performance compared to peers across the continent.

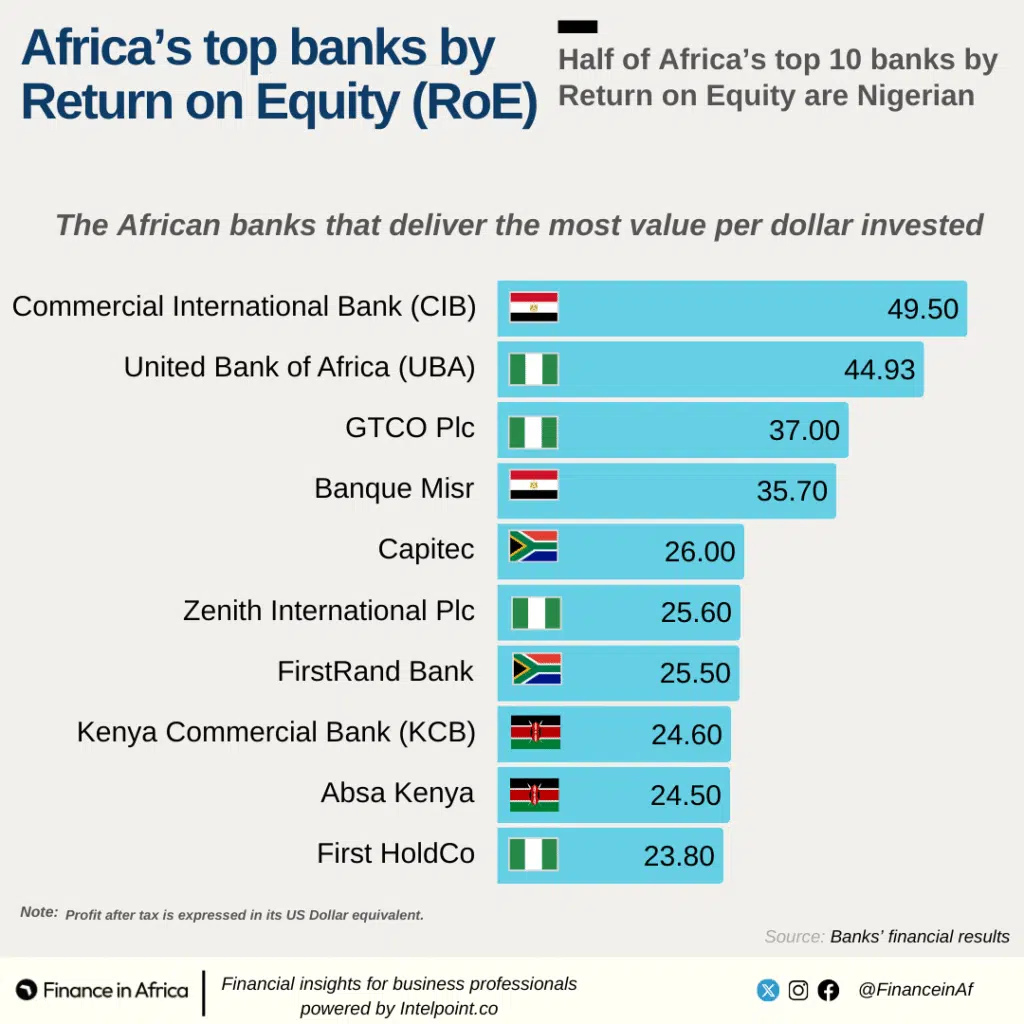

How it looks in Africa

- Commercial International Bank 49.5%

- United Bank of Africa (UBA) 44.93%

- GTCO Plc 37.0%

- Banque Misr 35.7%

- Capitec 26.0%

- Zenith International Plc 25.6%

- FirstRand Bank 25.5%

- Kenya Commercial Bank (KCB) 24.6%

- Absa Kenya 24.5%

- First HoldCo 23.8%

When measured by absolute profit, South African and Egyptian banks remain dominant forces in Africa’s banking landscape. But as this Return on Equity analysis reveals, profit alone doesn’t tell the full story.

RoE shines a light on operational efficiency and capital productivity—how well banks convert shareholder equity into returns. By this metric, Nigerian and Egyptian banks lead the continent.

While Return on Equity tells us how well banks reward their shareholders, it doesn’t capture the full picture of capital efficiency—especially for institutions balancing equity with large debt positions or vast asset bases.

In the next part of this series, we shift focus to Return on Capital (RoC)—a more comprehensive metric that reveals how effectively banks convert all available capital into profit. And once again, the results may surprise you.

→ Up next: Which African banks are the most capital efficient?