Lesotho, one of Africa’s smallest countries, faces a sharp economic slowdown in 2025, with Gross Domestic Product (GDP) growth projected to fall below 1% as it braces for a proposed 50% tariff on exports to the US.

This would mark the southern African nation’s weakest performance since 2020, when GDP contracted by 8.2%, according to the African Development Bank (AfDB).

In its latest country focus report, the Bank estimates Lesotho’s economy grew by 2.4% in 2024, up from 1.8% in 2023, driven by a stronger service sector and large-scale government infrastructure projects.

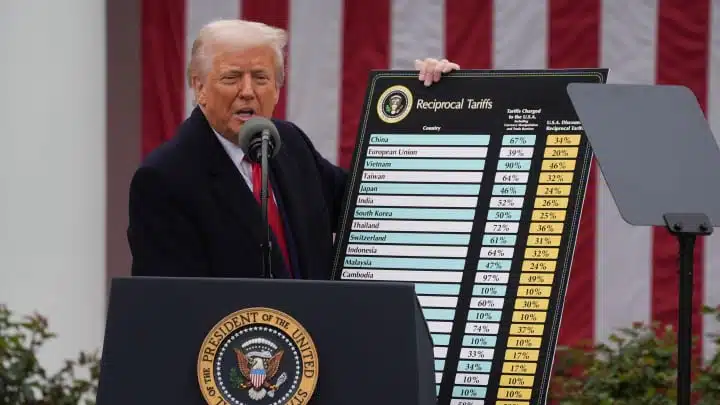

Despite its small size, Lesotho was among the hardest hit when US President Donald Trump announced what he described as “reciprocal tariffs” on all of America’s trading partners on April 2, 2025.

Although currently on hold, the proposed 50% tariff threatens to derail recent economic gains.

AfDB warns that, if implemented, it would significantly affect Lesotho’s textile and apparel exports — key beneficiaries of duty-free access under the African Growth and Opportunity Act (AGOA), which expires in September 2025.

Textile exports to the US accounted for roughly 47% of Lesotho’s total textile shipments and were valued at over $200 million last year. The Bank estimates the tariffs could trigger a 20–30% decline in orders, reducing export earnings by up to $60 million.

“This could push GDP growth below 1%, especially if factory closures or retrenchments accelerate,” the report said.

The Bank also flagged longer-term risks, noting that Lesotho’s outlook depends on its ability to diversify export markets and improve supply chain efficiencies.

“If diversification efforts stall, Lesotho may face further declines in investment, factory relocations, and job losses in its already fragile manufacturing base, undermining tax revenue,” It added.

Lesotho declares state of disaster as jobs disappear

In early July, Lesotho declared a two-year state of disaster in response to mounting youth unemployment and widespread job losses, exacerbated by tariff-related uncertainty.

Mokhethi Shelile, the country’s trade minister, told reporters that following the tariff announcement, orders from US buyers fell sharply, prompting factory shutdowns and mass layoffs.

These pressures persist, despite a 90-day pause on US tariffs from April 9 to July 9, as lingering uncertainty and an additional 10% import levy prompt buyers to seek alternative markets.

According to official figures, Lesotho’s national unemployment rate now stands at 30%, rising to nearly 50% among younger people — making it one of the highest globally.

Deputy Prime Minister Nthomeng Majara said the disaster declaration — which allows the government to take all necessary steps to mitigate the crisis — will remain in effect until June 30, 2027.

The unemployment crisis has been compounded by recent cuts to U.S. aid, which have already resulted in at least 1,500 job losses in Lesotho’s healthcare sector.

“The suspension of key U.S. assistance, particularly the President’s Emergency Plan for AIDS Relief (PEPFAR) and the United States Agency for International Development (USAID), has severely disrupted the health sector, resulting in the loss of approximately 1,500 healthcare jobs and setbacks in HIV/AIDS prevention, treatment and outreach,” the AfDB said.

“Moreover, other donors have signalled potential funding cuts, adding to uncertainty in the global aid landscape.”

Tariffs on South Africa could deepen Lesotho’s economic woes

While Lesotho’s tariff exposure could have a devastating impact, the AfDB warns that broader and more significant risks stem from tariff developments in South Africa — Lesotho’s largest trading partner and a key driver of Southern African Customs Union (SACU) revenues.

The US imposed a 30% levy on South African exports at the end of the 90-day pause, effective August 1.

Although Lesotho was not targeted in that announcement, its economy remains tightly bound to South Africa’s performance through trade, remittances and shared customs revenues.

Over half of Lesotho’s exports go to South Africa, and its migrant workers in South African mines and factories are a major source of household income back home.

According to the AfDB, a slowdown in South Africa’s economy could lead to fewer employment opportunities for migrant workers, reducing remittance inflows and weakening household consumption in Lesotho.

Lower trade volumes could also cut into SACU revenue transfers — a vital source of public funding for Lesotho — straining the government’s ability to meet its fiscal targets.

“Long-term risks include deindustrialisation, a further rise in unemployment, and social instability,” the bank cautioned. “Poverty levels could rise, particularly in urban centres which are heavily reliant on factory employment.”

However, the AfDB adds that with targeted investment and support, Lesotho could begin to reorient production towards regional markets and gradually reduce its vulnerability to U.S. policy shocks.