Ghana’s central bank lowered its benchmark lending rate by 350 basis points to 21.5% on Wednesday, bringing borrowing costs to their lowest level since May 2022.

The Bank of Ghana (BoG) said the move reflected continued disinflation and confidence that price growth would return to target before year-end.

Governor Johnson Asiama, who announced the decision in Accra, said the cut was backed by a majority of the monetary policy committee.

“Given the current state of macroeconomic conditions, the view of the Committee was that inflation will continue to ease in the near term,” he noted.

“In the outlook, headline inflation is expected to drop to within the medium-term target of 8 ± 2 percent by the end of the fourth quarter.”

Inflation trend and drivers

Consumer price growth has slowed steadily in 2025, easing for the eighth straight month in August to 11.5% from 12.1% in July — the lowest in four years and below the bank’s year-end target of 11.9%.

The BoG attributed the moderation to tighter monetary and fiscal policies, stronger food supply and a more stable currency.

The cedi, which gained more than 40% against the dollar by mid-year, has since weakened 14%, trimming its year-to-date appreciation to 20%, Bloomberg data show.

The depreciation, however, was largely anticipated, as dollar demand typically rises ahead of the holiday season to support business import needs.

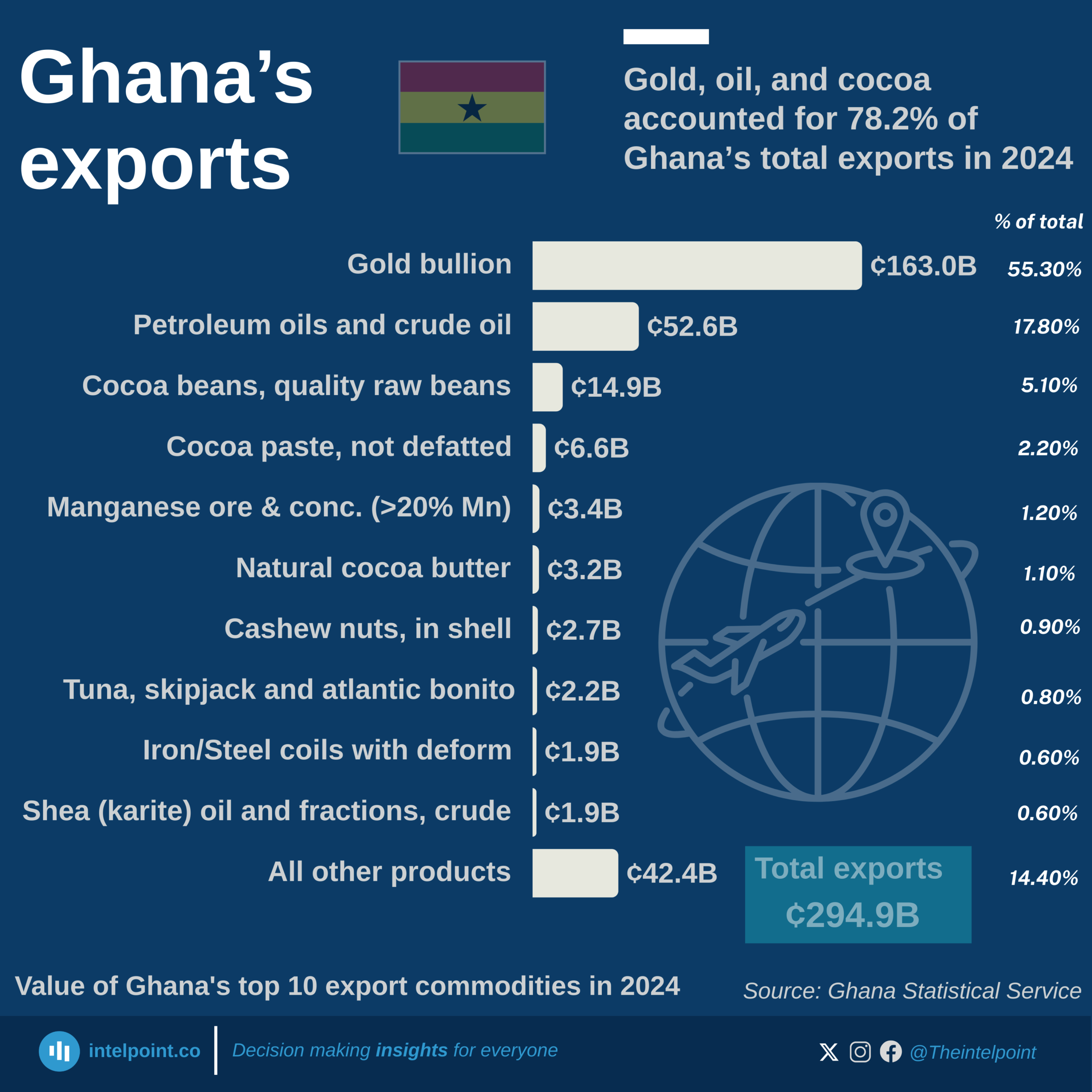

Asiama said upcoming foreign exchange inflows from gold and cocoa should stabilise the currency. The state’s Gold Board has plans to begin local refining in October to boost export earnings.

Strengthening external sector

The external position has improved markedly, with a trade surplus of $6.2 billion in the first eight months of 2025, nearly triple the $2.1 billion recorded a year earlier.

Gold and cocoa exports led the gains, offsetting import growth.

Gross international reserves stood at $10.7 billion at the end of August, equal to 4.5 months of import cover, compared with $8.98 billion at the end of 2024. The bank expects the sector to remain resilient, supported by favourable commodity prices and remittance inflows.

Recovery gathers pace

After one of its worst economic crises in decades, Ghana is showing signs of a sustained rebound. The economy expanded 6.7% in the second quarter, up from 5.7% a year earlier, marking the fastest growth in nine months.

Excluding oil, growth accelerated to 7.8% as non-oil sectors strengthened. A $360 million World Bank facility is also set to support macroeconomic stability and reinforce investor confidence.

However, risks remain. Analysts warn that a planned electricity tariff hike could stoke renewed inflationary pressures and challenge the disinflation path that has allowed the BoG to ease policy for a second consecutive time in 2025.