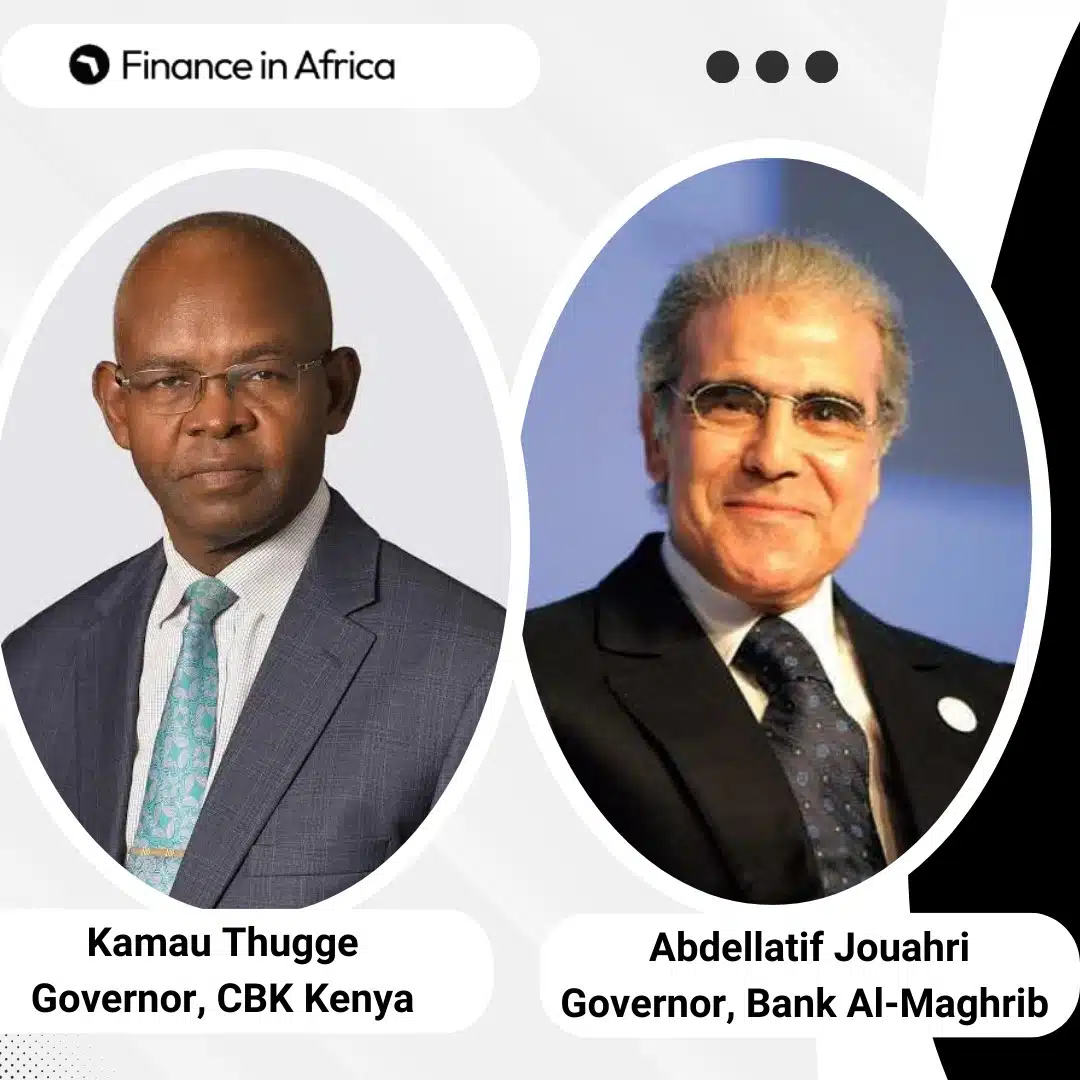

Kenya’s Kamau Thugge and Morocco’s Abdellatif Jouahri have earned top marks in Global Finance magazine’s 2025 ‘Central Banker Report Cards,’ placing ahead of peers from Egypt, Ethiopia, South Africa, and Uganda in the annual global ranking.

The report cards, published since 1994, grade nearly 100 central bank chiefs worldwide on inflation control, currency stability, and policy independence. Ratings range from “A+” for exceptional performance to “F” for outright failure.

In the latest edition, Thugge and Jouahri received “A” grades, while Hassan Abdalla of Egypt, Mamo Mihretu of Ethiopia, Lesetja Kganyago of South Africa and Michael Atingi-Ego of Uganda each scored “A-”.

“Our annual central banker report cards recognise those leaders who have not only delivered results but done so with independence, discipline and strategic foresight,” said Joseph Giarraputo, Global Finance’s Founder and Editorial Director.

The results underscore Africa’s growing reputation for disciplined monetary management amid global volatility.

According to the report, Thugge and Jouahri anchored investor confidence through inflation-focused frameworks and currency-stability policies that strengthened monetary credibility.

Since Thugge was appointed Kenya’s central bank governor in July 2023, inflation has eased sharply from peaks above 9% in 2022 to within the bank’s 2.5%–7.5% target range.

The improvement has been supported by an aggressive monetary-easing cycle of seven consecutive rate cuts totalling 325 basis points, lowering the policy rate to 9.5% by August 2025 from 12.57% a year earlier.

Morocco’s veteran central banker has overseen an even more dramatic disinflation. Inflation fell from about 10% in February 2023 to just 0.3% in August 2025, well below the 2% projection, reflecting the impact of rate revisions and policy adjustments.

The “A-” rated governors have also been credited with steering their economies through surging global interest rates, commodity-price swings, and currency depreciation while maintaining policy independence.

In Ethiopia, Mihretu — who had resigned earlier in September — initiated sweeping reforms widely described as the country’s most significant economic changes in 50 years, stabilising its economy during a vulnerable period.

“Most African central bankers have spent the past few years battling inflation with their most effective tools. As inflation recedes, we’re beginning to see the results of those tough policy decisions,” Giarraputo added.

The recognition could embolden African central banks to maintain or refine their monetary frameworks as they navigate the next phase of global economic uncertainty.