Nigeria’s Federal Inland Revenue Service (FIRS) and the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) have inaugurated a joint technical committee to improve how tax revenue is tracked and managed.

The committee was launched on Tuesday at the FIRS headquarters in Abuja. According to an official statement, the goal is to strengthen revenue monitoring and ensure better financial planning and sustainability across Nigeria’s federal, state, and local governments.

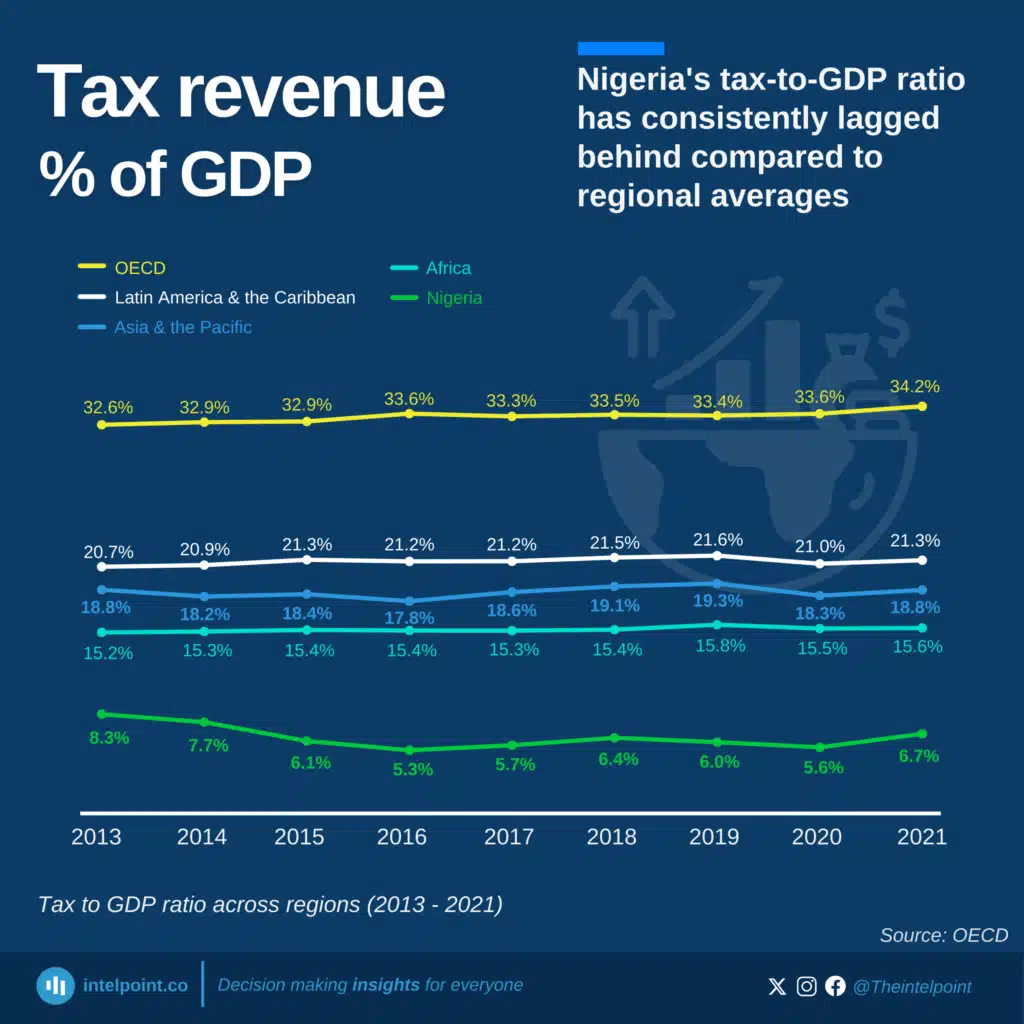

With the establishment of the new joint committee, Nigeria plans to shift its focus toward tax revenue rather than oil to fund national development. This represents a major change in the country’s fiscal strategy.

Why this matters

For decades, Nigeria depended heavily on oil earnings, but the volatility of global oil prices has exposed the fragility of that model. In 2024 alone, Nigeria generated about $31.7 billion from crude oil, based on an average price of $80.53 per barrel and production of over 408 million barrels.

However, tax revenue remains critical; between January and November 2024, the FIRS collected $12.5 billion, with non-oil taxes contributing $9.2 billion.

This shift aligns Nigeria with more diversified economies like South Africa, which collected over $100 billion in tax revenue in 2023 and relies primarily on taxation to support public services.

In contrast, Angola, a resource-rich country like Nigeria, still derives about 60% of its revenue from oil, making it vulnerable to external shocks. South Korea, meanwhile, has maintained strong economic growth through a broad and efficient tax system combined with industrial diversification.

In 2024, this tax revenue made up about 65% of all funds shared between the three levels of government, more than what Nigeria earned from selling crude oil.

By forming this committee, the government wants to make sure that every naira collected in tax is carefully tracked and properly used. It also means the local and state governments are expected to take revenue generation more seriously, not just wait for oil money or federal allocations.

How the committee plans to track tax revenue

Nigeria’s FIRS and the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) plan to track tax revenue through three detailed methods recently unveiled to improve transparency and efficiency.

Integrated Tax Administration System (ITAS)

In February 2024, the government launched a new digital system called ITAS during a tax strategy retreat in Abuja. It’s a one-stop platform that brings together all tax activities — from registration to payment — for federal, state, and local governments.

The goal is to make things easier for taxpayers while cutting out errors and loopholes. Everything’s done online, so it’s faster, more transparent, and easier to track who’s paying and who’s not.

Satellite and geospatial data

The use of space technology for tax monitoring was announced on January 30, 2025, at the RMAFC headquarters in Abuja.

This initiative involves collaboration with the National Space Research and Development Agency (NASRDA) to employ satellite imagery and geo-spatial data in monitoring economic activities such as agriculture, mining, real estate development, and other business operations.

This approach helps identify unregistered or under-reported businesses and assets, thereby widening the tax base and improving revenue collection accuracy.

National Revenue Dashboard

The National Revenue Dashboard was proposed during a joint three-day retreat of FIRS and RMAFC held from April 29 to May 1, 2025, in Uyo, Akwa Ibom State. This dashboard is a centralised, real-time platform that integrates revenue inflows from all tax agencies across Nigeria.

It provides government officials at all levels with instant access to tax collection data, enhancing transparency, enabling prompt fiscal planning, and ensuring accountability in the distribution and utilisation of tax revenues.

The big picture

The message is clear: as oil declines, African governments like Nigeria’s must learn to stand on their own feet by building stronger and fairer tax systems.\

Across Africa, some countries have already taken steps to strengthen tax systems with success. Rwanda introduced digital tax systems and focused on transparency, which helped increase revenue and fund development.

In Kenya, the iTax platform made tax payment easier and helped grow revenue by over 18% in just one year. South Africa’s strong tax collection system funds most of its national budget, showing that natural resources are not the only growth path.