Capital Markets

Kenya digitises 16bn Safaricom shares as electronic registry nears full coverage

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

South African bonds rally after central bank’s dovish 25bps cut

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Ghana’s dollar bond edges up as trade surplus, reserves lift economic outlook

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Angola forced to post $200m in JPMorgan swap as bond prices plunge

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Tanzania lifts Treasury bill bid limit tenfold to grow local debt market

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

“Forget fintech or traditional—only adaptive asset managers will survive” – the industry veteran rewriting the rules of investment in Nigeria

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Kenya has digitised 16 billion Safaricom shares, bringing the Central Depository’s electronic holdings to 97 billion and marking a major step toward full dematerialisation.

Following a downward revision of inflation forecasts, South Africa’s central bank resumed its rate easing cycle on Thursday, cutting the benchmark lending rate to 7.25% — the lowest level since 2022.

Ghana’s 2035 Eurobond recorded a marginal increase in price on Monday, following fresh data from the Bank of Ghana that indicated a stronger external account and improving debt position.

Angola was forced to cough up a $200 million margin call to JPMorgan following a sharp drop in the price of bonds used as collateral for a $600 million financing deal, its finance ministry said on Tuesday.

In bid to boost investor participation and enhancing pricing efficiency, the Bank of Tanzania has raised the maximum bid amount under the non-competitive window from $18,600 to approximately $186,000 per auction.

Top stories

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.

By pushing Kenya’s electronic share registry to 97 billion shares, the move marks a significant step toward full dematerialisation of securities and is expected to boost liquidity, transparency, and investor confidence.

The central bankers noted that the decision to cut rates was driven by lower inflation expectations and a more benign outlook for the economy.

The modest price gain signals cautious optimism among investors toward a bond that has been under continuous pressure for nearly a month.

The Angolan government acknowledged that while the swap offered cost benefits, it also exposed the country to new financial pressures.

The latest adjustment is poised to rebalance the government’s domestic debt profile—currently dominated by Treasury bonds—by attracting a broader pool of investors into the short-term market.

We sat down with the Gbenga, who’s bringing 17 years of traditional asset management expertise to Sycamore—to discuss the future of investing in Nigeria

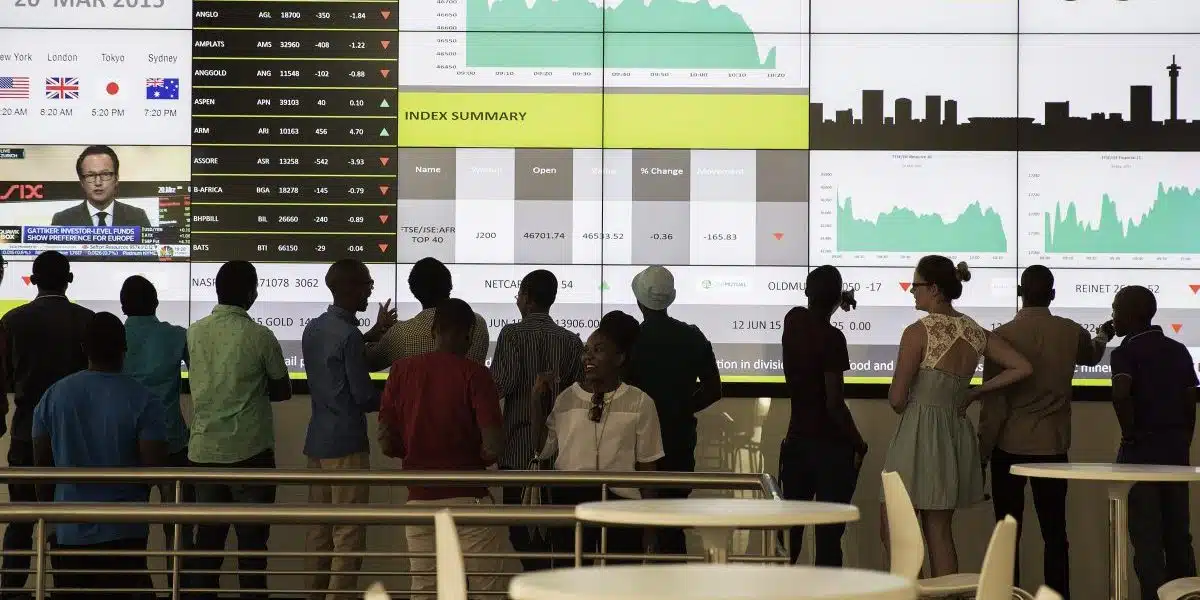

The massive roll-out of policies in Donald Trump’s era is creating an uncertain market with African bourses receiving their fair share

South Africa’s performing brokers contribute significantly to the substance of transactions on the Johannesburg securities exchange

Kenya has digitised 16 billion Safaricom shares, bringing the Central Depository’s electronic holdings to 97 billion and marking a major step toward full dematerialisation.

Following a downward revision of inflation forecasts, South Africa’s central bank resumed its rate easing cycle on Thursday, cutting the benchmark lending rate to 7.25% — the lowest level since 2022.

Ghana’s 2035 Eurobond recorded a marginal increase in price on Monday, following fresh data from the Bank of Ghana that indicated a stronger external account and improving debt position.

Angola was forced to cough up a $200 million margin call to JPMorgan following a sharp drop in the price of bonds used as collateral for a $600 million financing deal, its finance ministry said on Tuesday.

In bid to boost investor participation and enhancing pricing efficiency, the Bank of Tanzania has raised the maximum bid amount under the non-competitive window from $18,600 to approximately $186,000 per auction.

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.