Industry Moves

Why Africa’s investors are choosing special economic zones over countries

Author

-

Pelumi is a freelance writer with over five years of experience spanning content, creative, and academic writing. His work cuts across lifestyle, cryptocurrency, self-improvement, and technical documentation, and he has published academic papers that reflect his blend of curiosity and research. He currently collaborates with Finance in Africa, covering stories on the continent’s financial landscape. Connect with him on LinkedIn and explore his portfolio on Muck Rack.

Author

-

Pelumi is a freelance writer with over five years of experience spanning content, creative, and academic writing. His work cuts across lifestyle, cryptocurrency, self-improvement, and technical documentation, and he has published academic papers that reflect his blend of curiosity and research. He currently collaborates with Finance in Africa, covering stories on the continent’s financial landscape. Connect with him on LinkedIn and explore his portfolio on Muck Rack.

Ethiopia’s Zemen Bank taps Afreximbank, TDB for $85m trade line

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

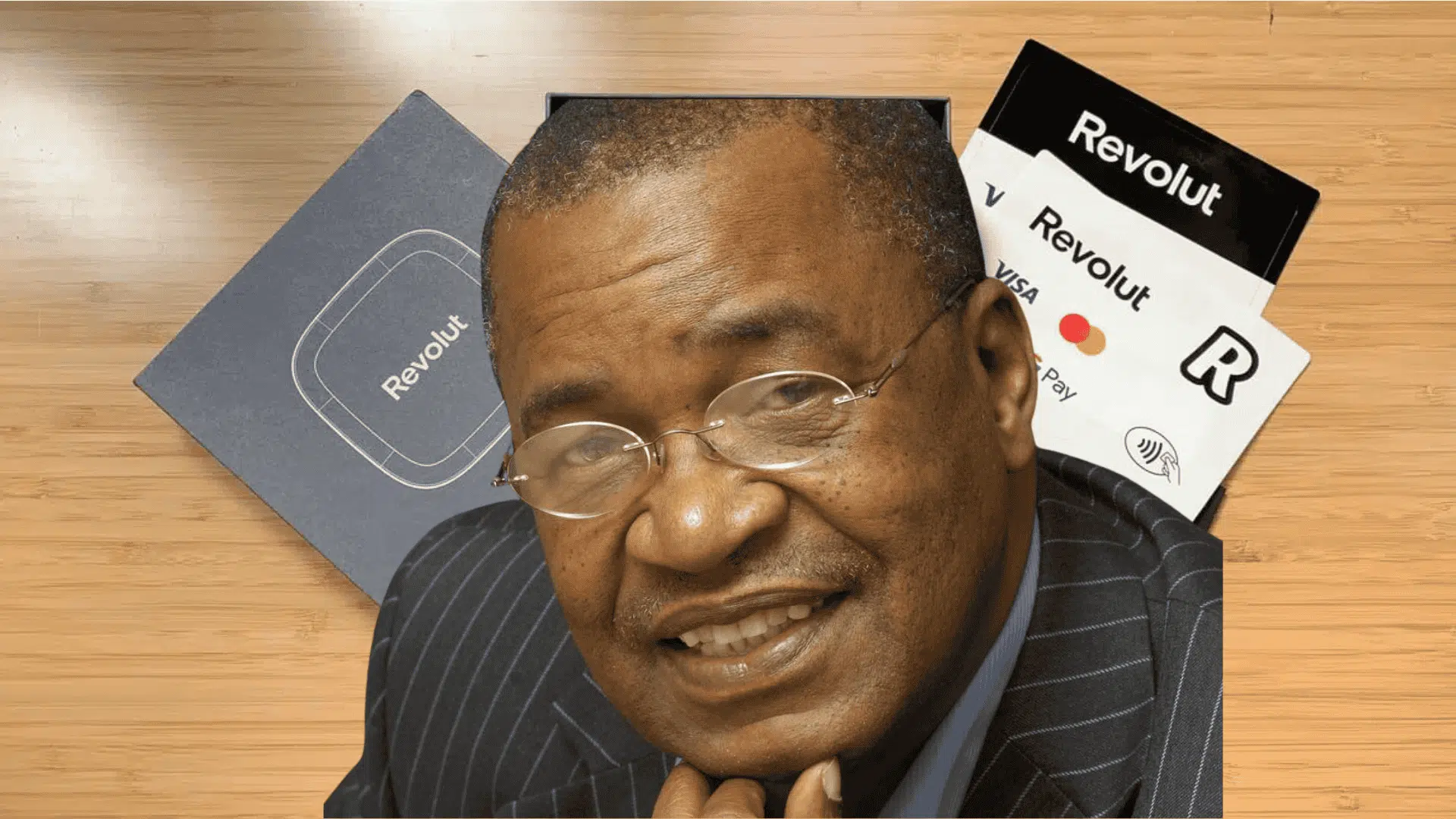

Revolut appoints veteran, Gaby Magomola, applies for banking licence in South Africa

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

JPMorgan resumes dollar clearing in Angola after 10-year hiatus

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Africa’s biggest bank enters Egypt to tap trade flows

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Zambia joins African peers in cutting interest rates in 2025

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Uganda holds key policy rate at 9.75% as inflation hits seven-month low

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Nigeria’s $2.4bn Eurobond sale seen lifting external debt ratio above target

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Revolut names ex-Mastercard exec, Yacine Faqir, as Morocco CEO, deepens North Africa expansion

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

How much Nigerian Access Holdings is paying for Kenya’s National Bank

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Nigeria’s new pension rule seen unlocking $600m for private equity

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Ethiopia limits foreign ownership in banks to 49% as reforms deepen

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Ghana lifts suspension of UBA’s FX trading licence after one month

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Cash shortages force Libya to print $11bn in new notes

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Namibia cuts key rate to 3-year low amid weak growth, price pressures

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Ethiopia resumes dollar sales with $150m injection to ease currency pressures

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Top stories

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.

For a long time, Africa’s investment landscape has been framed as a market-size problem. Over time, it appeared that the solution was simply to scale up: bigger populations, faster urbanisation, rising consumption. Yet capital inflows remained uneven.

The funding will allow the lender to issue more letters of credit, guarantees, and collections, helping clients navigate Ethiopia’s foreign-currency-constrained market.

Revolut has appointed banking veteran Gaby Magomola and applied for a South African banking licence, signalling a shift from payments to regulated digital banking.

Prateek Suri, Chairman of Maser Group and the Richest Indian in Africa, has seen his wealth leap to $1.9 billion following the clearance of ownership rights to an island in West Africa

he move makes JPMorgan the first US bank to re-enter the Angolan market since major international lenders withdrew in the mid-2010s over compliance concerns.

The new representative office in Cairo underscores Standard Bank’s long-term view of Egypt as a key node for intra-African commerce and Gulf–Africa connectivity.

The Bank of Zambia has reduced its key lending rate for the first time in over five years, citing slowing inflation in Africa’s second-largest copper and cobalt producer.

The decision comes three days after S&P Global Ratings upgraded the country’s sovereign rating outlook to “positive” from “stable,” citing stronger growth prospects and rising per capita income.

Nigeria’s latest Eurobond issuance could keep the country’s external debt-to-total debt ratio slightly above the Debt Management Office (DMO) threshold of 45% by year-end, according to analysts at CSL Research.

Revolut has named ex-Mastercard executive Yacine Faqir as CEO for Morocco, deepening its North Africa push and signalling a shift toward locally led digital banking expansion.

Access Holdings Plc, Nigeria’s biggest banking group by assets, will pay $109.6m (₦179.1bn) to complete the acquisition of National Bank of Kenya (NBK) from KCB Group Plc, according to its latest financial report.

The National Pension Commission (PenCom) in September announced that the new regulation applies to Nigerians living and working abroad, as well as employees of foreign companies and international organisations in Nigeria not covered by the Pension Reform Act (PRA) of 2014.

The move comes four months after Ethiopia officially opened its banking industry to foreign investors for the first time in nearly five decades, signaling a cautious but strategic liberalisation of the sector.

The reinstatement brings relief to UBA Ghana, which is among the country’s major commercial banks with a strong presence in corporate and retail banking.

Despite its vast oil wealth, Libya has faced years of cash shortages that have forced citizens to queue outside banks to withdraw limited funds.

The German multinational logistics and supply chain management company is doubling down on Africa’s trade future with a $349.6m investment targeting logistics expansion across its express, global forwarding, and supply chain division.

Consumer prices have eased sharply from last year’s highs, however, erratic movements and a slight uptick in September 2025 point to persistent price pressures.

Data from the Nairobi Securities Exchange show NCBA’s share price surged to KSh 75.25 ($0.56) at Tuesday’s close — its highest on record. The group, currently the most expensive banking stock on the NSE, maintained strong momentum in Wednesday’s intraday trading.

The central bank said the upcoming auction, which marks the tenth since the East African nation launched its new foreign exchange trading system in August 2024, follows months of robust inflows and rising reserves.

Wegagen’s management attributed the capital surge to strategic balance-sheet strengthening, business diversification, and an accelerated digital rollout.

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.