Investment

Libya becomes shareholder in Afreximbank amid economic recovery

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Access Bank completes acquisition of National Bank of Kenya from KCB Group

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Jumia loses largest investor, as Baillie Gifford dumps its entire shares

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Zambia remains in default to Afreximbank, TDB as $583m debt talks stall

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

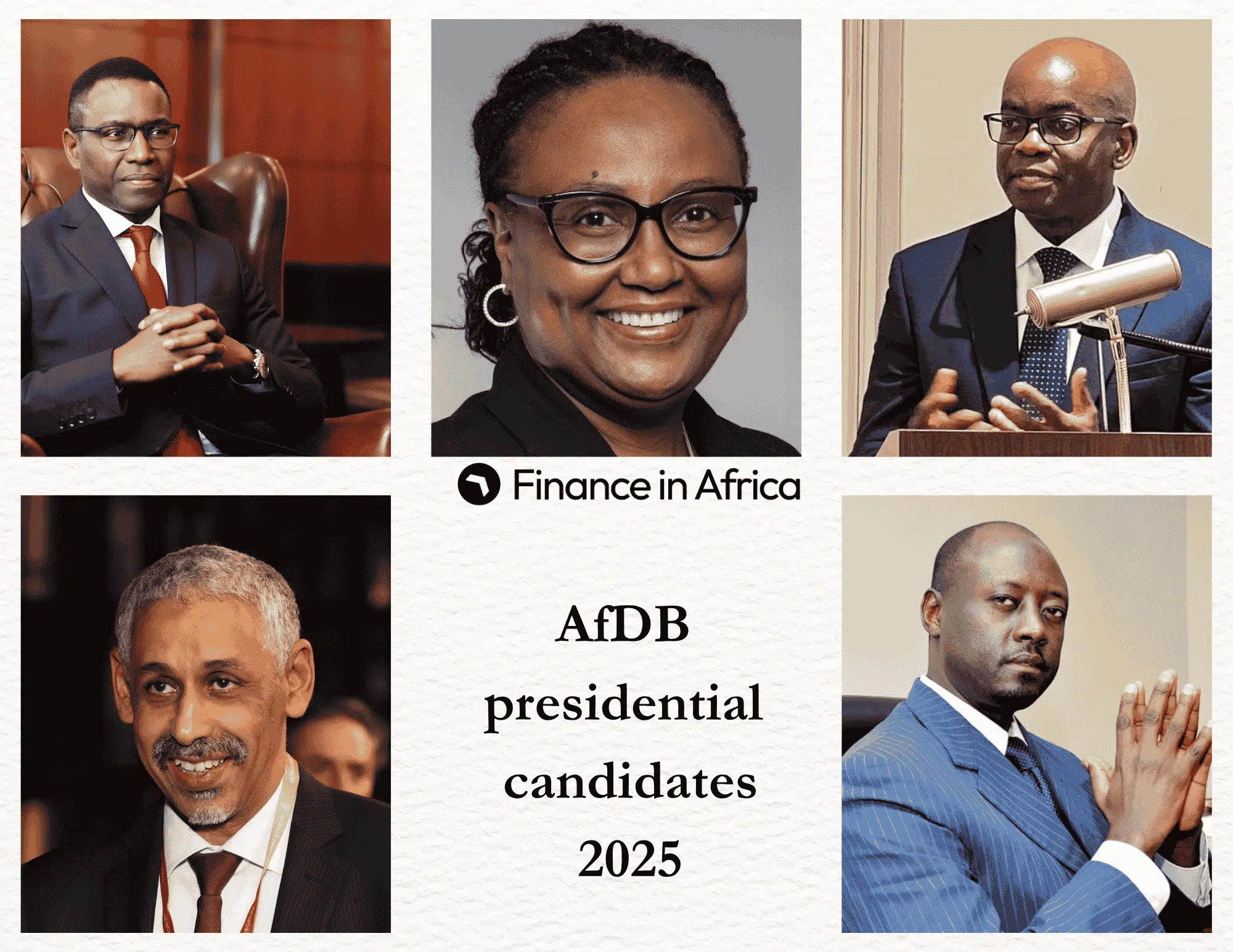

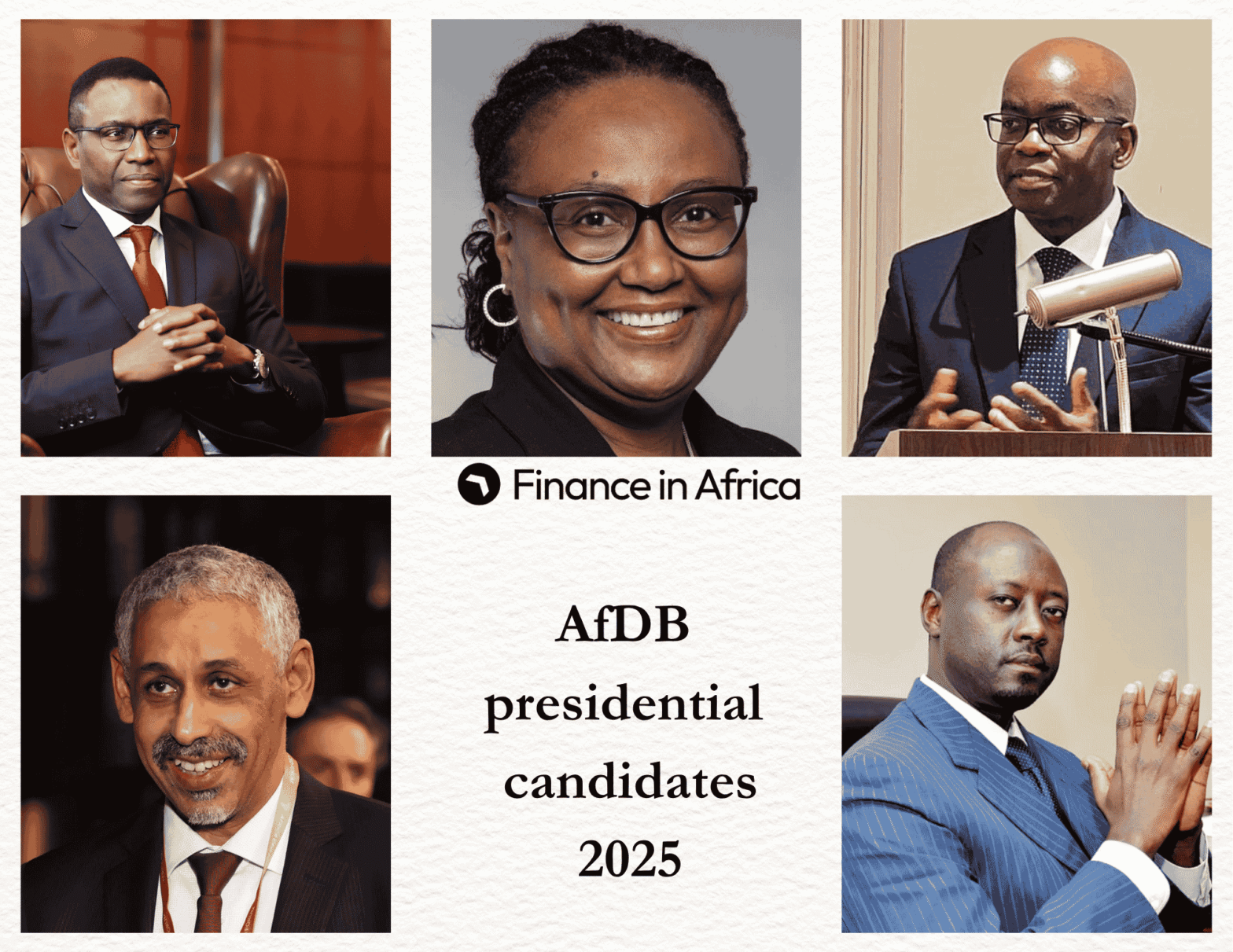

Meet the AfDB presidential contenders, and their plans for Africa’s financial future

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Nigeria moves to close liquidity gap in Islamic finance with new non-interest instruments

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

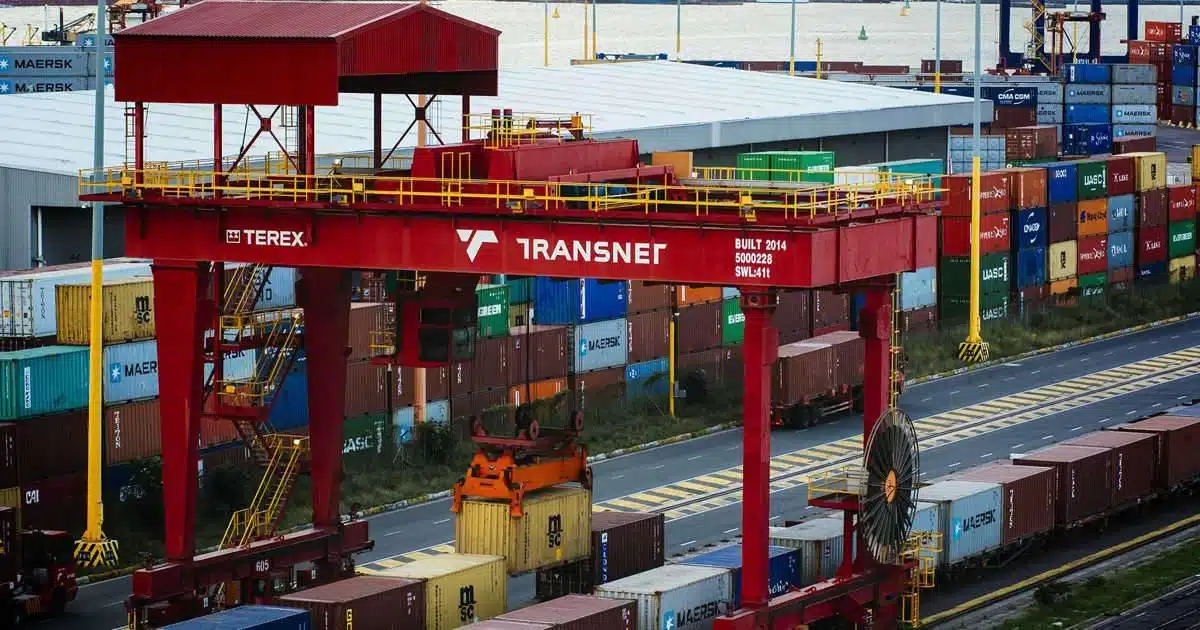

What you should know as South Africa’s Transnet secures $2.8bn guarantee to avert collapse

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

South Africa’s Investec announces $139 million share buyback

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

Author

-

Nasiru Ibrahim is a dedicated journalist, reporter, and writer with a strong academic background in Economics. He combines in-depth research with clear, accessible writing to produce insightful articles on finance, technology, and socio-economic issues. His work has been featured across various newspapers and online platforms, where he is known for making complex topics understandable to the general public. With over five years of experience in business and journalism, Nasiru has developed a reputation for critical thinking and data-driven analysis. He is currently conducting research on “Inflation as an Invisible Tax”, exploring its hidden impacts on livelihoods. You can connect with him on Linkedin Nasiru Ibrahim

European lender approves Nigeria, Ivory Coast and Benin for investment rollout

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Kenya ditches IMF loans, taps World Bank and AfDB for next three years

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Namibia’s largest pension fund raises payouts by 4% as assets reach $8.8bn

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

J.P. Morgan pulls support for Nigeria’s carry trade as oil slumps, global risks rise

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Inflation fears push Nigeria’s $14.6bn pension fund to rethink investment strategy

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Nigeria posts $6.8bn BoP surplus on hot money inflows, but FDI slump signals caution

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Nigeria misses Eurobond coupon deadline, settles days later

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Libya officially became the 52nd shareholder of the African Export-Import Bank (Afreximbank) on May 13, 2025

The $510 million deal reflects diverging strategies as TotalEnergies retreats from high-emission assets, while Shell doubles down on upstream growth in Africa.

Access Bank has acquired National Bank of Kenya from KCB Group in a $102 million deal, expanding its presence in East Africa. NBK will operate independently for now, pending full integration.

Zambia remains in default as debt restructuring talks with regional lenders Afreximbank and TDB stall, prolonging economic uncertainty and challenging the country’s path to debt sustainability.

In a landmark move, Nigeria’s central bank has launched three new Islamic finance instruments to improve liquidity management and deepen non-interest banking—addressing long-standing structural gaps.

The Federal Government has inaugurated a new 10-member Board of Directors for the Asset Management Corporation of Nigeria (AMCON), signalling a renewed commitment to financial sector reforms.

South Africa extends a $2.8 billion guarantee to Transnet to cover funding and debt servicing amid years of decline, corruption, and theft. The move aims to stabilise key logistics and protect the economy

South Africa’s Investec Ltd. plans a $139.2 million share buyback over the next year, aiming to boost shareholder returns and strengthen investor confidence amid a challenging economic environment

Dangote Group has signed an export deal with Vinmar International to supply polypropylene from its $2 billion Lagos plant.

Nigeria, Côte d’Ivoire and Benin have formally joined the European Bank for Reconstruction and Development as recipient countries following an upgrade on Thursday, paving the way for fresh investments in West Africa.

Dangote-backed Alterra Capital’s acquisition of Pollman’s Tours showcases a strategic push into East Africa’s booming consumer experience economy.

Kenya has indicated that it has no plans to finance its budget for the next three years with funds from the International Monetary Fund (IMF), marking a significant departure from the country’s previous reliance on the multilateral lender.

Namibia’s largest pension fund has raised pension payouts by 4% from April 1 2025, citing strong financial health and inflation trends.

J.P. Morgan has withdrawn support for Nigerian T-bills, warning that falling oil prices and renewed global tensions could expose Africa’s largest economy to deeper macroeconomic risks.

Nigeria’s pension regulator, PenCom, has disclosed plans to restructure its investment strategy in response to mounting inflationary pressures.

Fresh central bank data shows Nigeria posted a Balance of Payments (BoP) surplus of $6.83 billion in 2024, marking a sharp reversal from consecutive deficits in the previous two years.

Nigeria has confirmed payment on a $4bn Eurobond coupon after initially missing its 28 March deadline, citing public holidays and “transition issues” for the delay.

Top stories

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.

Libya officially became the 52nd shareholder of the African Export-Import Bank (Afreximbank) on May 13, 2025.

In a strategic portfolio shift, TotalEnergies has divested its 12.5% stake in Nigeria’s Bonga, a move from high-cost, high-emission assets, reflecting broader diverging among oil majors

Access Bank has acquired National Bank of Kenya from KCB Group in a $102 million, expanding its presence in East Africa. NBK will operate independently for now, pending full integration.

Dr. Adesina’s AfDB tenure saw $273B+ mobilised for energy, food, and industry, but progress on trade and livelihoods lagged amid conflict, climate shocks and global crises.

The Amazon of Africa, has just lost its largest backer—after a Q1 revenue drop of 26% and only $110m left in the tank.

The latest stalemate between the copper producer and its regional lenders threatens to prolong the country’s economic uncertainty and cast a shadow on its path to debt sustainability.

The African Development Bank (AfDB) will pick its next president on May 29, 2025, at its annual meeting in Abidjan, Ivory Coast. The timing is critical. With a recent $555 million funding cut proposed by the United States, the bank faces pressure to steer Africa’s growth through tough global financial waters. The current president, Dr.…

By boosting liquidity management for Islamic banks, the CBN’s latest move marks a major step toward mainstreaming non-interest finance in Nigeria’s financial system.

In a bold reform push to stabilize Nigeria’s financial landscape, the Federal Government has inaugurated a new 10-member board for AMCON

The government’s $2.8 billion guarantee to Transnet targets debt relief and urgent infrastructure repair

Investec Ltd. has announced a $139.2 million share repurchase set to begin in May 2025 on the Johannesburg Stock Exchange.

Dangote’s new polypropylene plant, backed by a global export deal with Vinmar, signals Nigeria’s shift toward value-added exports.

The upgrade marks a significant shift in the lender’s expansion strategy beyond its traditional markets in Eastern Europe, Central Asia, and parts of the Middle East.

Alterra Capital, backed by Dangote and Rubenstein, has acquired Kenya’s iconic Pollman’s Tours — a bold private equity move into East Africa’s recovering tourism sector.

Although the eastern African leader has no plans to seek further funding from the IMF in the near term, its outstanding obligations to the lender, currently over SDR 2.8 billion, remain a concern.

The fund’s latest move aligns with it’s broader goal of protecting the purchasing power of Namibian annuitants amid economic changes.

With Brent crude hovering near the sub-$60 mark—Nigeria’s fiscal break-even—concerns are mounting that sustained low prices could reopen current account deficits and heighten macroeconomic vulnerabilities.

With 60% of the fund’s pension pot tied up in government debt, retirees remain heavily exposed to the effects of the West African nation’s mounting inflationary pressures.

While Nigeria’s portfolio investments more than doubled in 2024, foreign direct investment plummeted to nearly half of the previous year’s figure.

The finance ministry says Nigeria’s delayed Eurobond coupon—due 28 March—was paid within days. Investors had flagged the missed deadline.

Libya officially became the 52nd shareholder of the African Export-Import Bank (Afreximbank) on May 13, 2025

The $510 million deal reflects diverging strategies as TotalEnergies retreats from high-emission assets, while Shell doubles down on upstream growth in Africa.

Access Bank has acquired National Bank of Kenya from KCB Group in a $102 million deal, expanding its presence in East Africa. NBK will operate independently for now, pending full integration.

Zambia remains in default as debt restructuring talks with regional lenders Afreximbank and TDB stall, prolonging economic uncertainty and challenging the country’s path to debt sustainability.

In a landmark move, Nigeria’s central bank has launched three new Islamic finance instruments to improve liquidity management and deepen non-interest banking—addressing long-standing structural gaps.

The Federal Government has inaugurated a new 10-member Board of Directors for the Asset Management Corporation of Nigeria (AMCON), signalling a renewed commitment to financial sector reforms.

South Africa extends a $2.8 billion guarantee to Transnet to cover funding and debt servicing amid years of decline, corruption, and theft. The move aims to stabilise key logistics and protect the economy

South Africa’s Investec Ltd. plans a $139.2 million share buyback over the next year, aiming to boost shareholder returns and strengthen investor confidence amid a challenging economic environment

Dangote Group has signed an export deal with Vinmar International to supply polypropylene from its $2 billion Lagos plant.

Nigeria, Côte d’Ivoire and Benin have formally joined the European Bank for Reconstruction and Development as recipient countries following an upgrade on Thursday, paving the way for fresh investments in West Africa.

Dangote-backed Alterra Capital’s acquisition of Pollman’s Tours showcases a strategic push into East Africa’s booming consumer experience economy.

Kenya has indicated that it has no plans to finance its budget for the next three years with funds from the International Monetary Fund (IMF), marking a significant departure from the country’s previous reliance on the multilateral lender.

Namibia’s largest pension fund has raised pension payouts by 4% from April 1 2025, citing strong financial health and inflation trends.

J.P. Morgan has withdrawn support for Nigerian T-bills, warning that falling oil prices and renewed global tensions could expose Africa’s largest economy to deeper macroeconomic risks.

Nigeria’s pension regulator, PenCom, has disclosed plans to restructure its investment strategy in response to mounting inflationary pressures.

Fresh central bank data shows Nigeria posted a Balance of Payments (BoP) surplus of $6.83 billion in 2024, marking a sharp reversal from consecutive deficits in the previous two years.

Nigeria has confirmed payment on a $4bn Eurobond coupon after initially missing its 28 March deadline, citing public holidays and “transition issues” for the delay.

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.