Corporate Finance

Nigeria’s Fidelity Bank ends 7-year profit streak as H1 earnings slip

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Safaricom’s six-month earnings almost triples as Ethiopia loss narrows

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

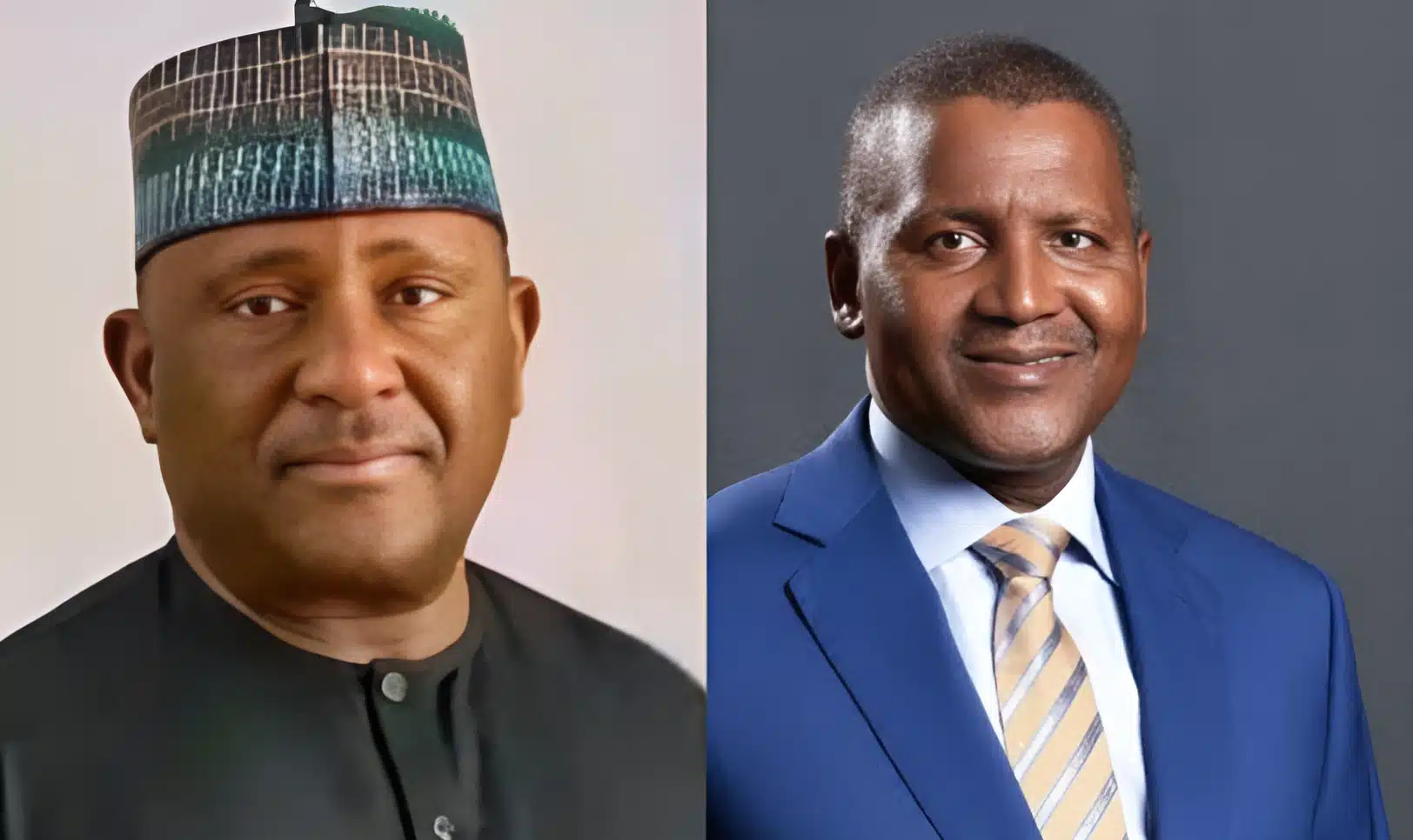

Nigeria’s BUA Cement beats Dangote in profit growth for second straight quarter

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Nigeria’s UAC buys Chivita, Hollandia for $1.5m, posts first quarterly loss in nearly two years

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Half of GTCO’s African banking units see profits drop to $223m as costs surge

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Tax reforms are reshaping Africa. Let’s talk about it

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

Author

-

I’m building Finance in Africa, a platform making financial information on banking, insurance, capital markets, and fintech across the continent more accessible and actionable. My work sits at the intersection of journalism, finance, technology and storytelling—with a focus on driving industry insight and professional relevance.

Previously, I was Brand Storyteller at Moniepoint, where I led thought leadership and business storytelling that shaped investor conversations and unlocked partnerships. I also served as Managing Editor at Techpoint Africa, where I directed coverage of Africa’s fintech and innovation economy. I’ve developed industry reports, interviewed global tech and finance leaders, and co-produced events and podcasts that reached hundreds of thousands.

Let’s connect on LinkedIn or Twitter (sorry X), or send tips to emmanuel@financeinafrica.com.

MTN Nigeria hits ₦10trn market value, second company ever after Dangote Cement

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

MTN Nigeria swings to record profit in H1, nears ₦10trn market value

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

MTN Nigeria crosses ₦9trn market cap, becomes most valuable firm

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Airtel Africa’s Q1: How 14 markets powered a $1.42bn revenue surge

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Author

-

Bunmi holds a degree in Economics from the University of Lagos and has over seven years of experience in content writing.

Her career includes roles as a financial and business journalist at BusinessDay Media and TechCabal, as well as leading the research team at SBM Intelligence—an Africa-focused market intelligence and strategic consulting firm.

She currently serves as Editor at Finance in Africa, a subsidiary of BusinessFront, publishers of Techpoint Africa, Energy in Africa. Catch up with her on Linkedin Bunmi Bailey.

Kenya enacts tax reliefs, approves $14.5bn budget amid persistent debt pressures

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Nigeria’s central bank rebounds with $23.7m profit after historic loss

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Author

-

Amarachi is a finance writer with a knack for turning complex economic data into compelling stories. With over half a decade of writing experience—spanning content creation, journalism, and on-the-ground reporting—she found herself in finance by accident but stayed for the thrill of decoding numbers that shape economies. Now, she covers the policies, trends, and market shifts that drive Africa’s financial landscape, making crucial information accessible to readers across the continent.

At Finance In Africa, Amarachi delivers sharp, data-driven insights tailored for bankers, investors, and finance professionals. She analyses central bank policies, fiscal reforms, and regulatory shifts, translating their impact into actionable intelligence. Her coverage spans banking performance, inflation, currency movements, capital markets, fixed income, and corporate earnings—helping industry players navigate risks and opportunities with confidence.

Connect with her on LinkedIn: Amarachi Orjiude-Ndibe.

Revolut’s Africa expansion faces statutory friction from South Africa’s fiscal regime

Author

-

Majesty is a law graduate, tax enthusiast, and creative writer.

She co-founded the Tax Club at the University of Port Harcourt and served as its pioneer Vice President, creating a platform for students to engage with real-world tax issues. Let’s catch up here.

Author

-

Majesty is a law graduate, tax enthusiast, and creative writer.

She co-founded the Tax Club at the University of Port Harcourt and served as its pioneer Vice President, creating a platform for students to engage with real-world tax issues. Let’s catch up here.

“You no longer need the taxman’s credit notes to offset your taxes” – Nigeria’s tax policy leader on new WHT rules

Author

-

Majesty is a law graduate, tax enthusiast, and creative writer.

She co-founded the Tax Club at the University of Port Harcourt and served as its pioneer Vice President, creating a platform for students to engage with real-world tax issues. Let’s catch up here.

Author

-

Majesty is a law graduate, tax enthusiast, and creative writer.

She co-founded the Tax Club at the University of Port Harcourt and served as its pioneer Vice President, creating a platform for students to engage with real-world tax issues. Let’s catch up here.

8 questions answered to help you understand Nigeria’s new revenue system better

Author

-

It is comparing the inflation rate between February 2024 and that of 2025. The rates are different because last year’s own was higher than this year’s.

Then the rebasing inflation index that we now used, (that was changed to last month) means that we use each year as its own base year for calculating inflation unlike previously when we use other years for the base year calculation. Catch up with me on LinkedIn here.

Author

-

It is comparing the inflation rate between February 2024 and that of 2025. The rates are different because last year’s own was higher than this year’s.

Then the rebasing inflation index that we now used, (that was changed to last month) means that we use each year as its own base year for calculating inflation unlike previously when we use other years for the base year calculation. Catch up with me on LinkedIn here.

Top stories

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.

The development comes a few weeks after the mid-sized bank slipped out of the ₦1trn market-capitalisation club.

This marks an increase of 192% from the same period in 2024, driven primarily by a narrower loss in its Ethiopian operations and sustained growth in mobile money and data services.

BUA Cement’s after-tax profit surged by 640.8% year-on-year in Q3 2025 — the highest growth among the top three cement makers. Dangote Cement followed with 149.8%, while Lafarge Africa posted 144.1%.

The conglomerate completed the acquisition of a 100% equity stake in C.H.I. Limited on October 3, 2025, making the beverage and dairy firm a wholly owned subsidiary.

According to data from the Nigerian Exchange Limited (NGX), Stanbic IBTC — the most expensive banking stock on the bourse — gained from ₦109 ($0.07) on Friday to ₦115 ($0.08) on Monday, maintaining that price through Tuesday’s close.

GTCO’s challenges mirror broader macroeconomic trends across Africa, where high inflation, rising interest rates, and currency volatility have eroded bank margins and dampened consumer spending.

From Nigeria to Kenya, sweeping tax reforms are rewriting the rules for business and investment in Africa. Join us Sept 30 for the big picture.

The telco gaint, which operates across 16 African markets and serves over 298 million customers, said Nigeria’s revenue rose by 54.1% to $1.54bn on a constant currency basis, while Ghana advanced 39.9% to $1.13bn.

Two days after acquiring CHI Limited, UAC of Nigeria’s share price has surged, making it the 36th most valuable company on the NGX—despite a profit dip in H1 2025.

MTN Nigeria Communications has emerged as the second listed company to hit the ₦10 trillion market capitalisation as its share price rose by 2% on Friday.

Mr Bigg’s and Debonairs reported a seventh straight half-year loss in H1 2025 as competition stiffened amid a cost-of-living crisis that has crimped consumer spending.

The telco giant’s performance, its highest half-year profit in at least eight years, comes just a day after it became the most valuable company on the Nigerian stock market, with its market value crossing the ₦9 trillion mark and surpassing Airtel Africa.

MTN Nigeria Communications Plc on Tuesday became the most valuable company on the Nigerian stock market, after its market capitalisation crossed the ₦9 trillion mark for the first time, overtaking Airtel Africa.

Airtel Africa, Nigeria’s second-largest telecom operator, recorded a 22.4% year-on-year revenue increase to $1.42 billion for the quarter ended June 30, 2025, up from $1.16 billion in the same period last year.

The signing comes a day after Kenyans returned to the streets to commemorate victims of last year’s nationwide protests, which were sparked by the highly controversial tax reforms proposed in the Finance Act 2024.

Q1 2025 marks a turnaround for Nigeria’s corporate giants, with many returning to profit as FX losses ease and business strategies adapt to a tougher economy.

While foreign exchange gains drove the rebound, the CBN’s earnings report also revealed a sharp drop in net interest income and surging liabilities, pointing to ongoing financial pressures.

Revolut plans to enter South Africa, but regulatory, tax, and labour hurdles could complicate its digital banking expansion.

New withholding tax rules will make companies handle tax deductions differently, impacting compliance and business operations.

TMRAS introduced by Nigeria’s OAGF has left Nigerians confused on the position of Remita. This article answers questions about the revenue system.

Leverage how money works in Africa

Get exclusive insights across banking, payments, and technology to gain a competitive advantage in Africa’s financial sector.